GBP/USD Technical Forecast: Neutral

- Fundamental continue to steer price action.

- GBP/USD client sentiment remains positive.

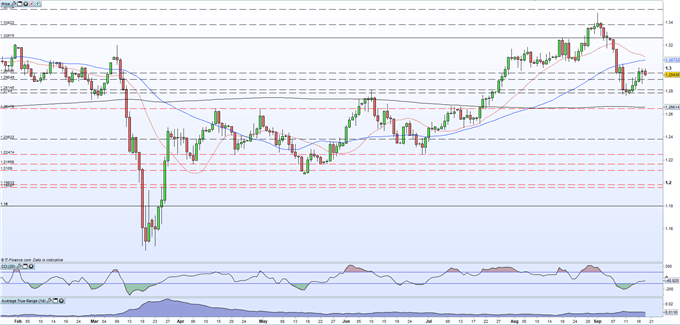

Sterling has partially recovered some of its recent losses against the US dollar and while the technical outlook looks neutral to marginally positive in the short-term, fundamentals will continue to drive price action going forward. The pair’s outlook remains neutral while below 1.3098 (50-dma) although the recent set of higher lows could enable GBP/USD to test this level in the short-term. Initial support around 1.2860 – 1.2875 ahead of stronger support off the recent lows between 1.2760 and 1.2810.

GBP/USD Daily Price Chart (February – September 18, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

IG client sentiment data shows 44.81% of traders are net-long with the ratio of traders short to long at 1.23 to 1. The number of traders net-long is 3.95% lower than yesterday and 12.07% lower from last week, while the number of traders net-short is 3.17% lower than yesterday and 21.59% higher from last week.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests GBP/USD prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger GBP/USD-bullish contrarian trading bias.

EUR/GBP Technical Forecast: Neutral

- Brexit pair becoming more volatile.

- The chart suggests higher prices but sentiment is mixed.

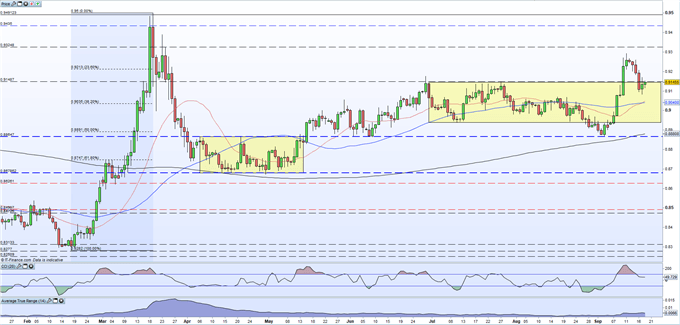

Last week’s rally through both the 20- and 50-day moving averages turned the market outlook bullish and while this remains the case, the pair are unlikely to move substantially lower. The pair balked at the 0.9300 last week and this level, backed up by the August 2019 swing-high at 0.9325, is likely to continue to act as stubborn resistance. The 20-dma has just crossed the 50-dma, highlighting recent bullishness, and these two moving averages either side of 0.9040 and the 38.2% Fibonacci retracement at 0.9035 will act as initial support.

EUR/GBP Daily Price Chart (January – September 18, 2020)

Retail trader data shows 38.80% of traders are net-long with the ratio of traders short to long at 1.58 to 1.The number of traders net-long is 4.20% lower than yesterday and 13.12% higher from last week, while the number of traders net-short is 0.49% higher than yesterday and 20.52% lower from last week.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Positioning is more net-short than yesterday but less net-short from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.