British Pound Sterling, GBP/USD, GBP/JPY, EUR/GBP Analysis

- It was a big week for the British Pound as the currency clawed back prior losses against USD, JPY and the Euro.

- GBP/USD has been in the midst of extreme volatility, making for a difficult backdrop for trend or momentum traders; but potentially presenting interest for breakout or swing strategies.

- GBP/JPY may be attractive for reversal potential while EUR/GBP May hold some interest for continuation scenarios.

British Pound Spikes Against USD After 35-Year-Lows

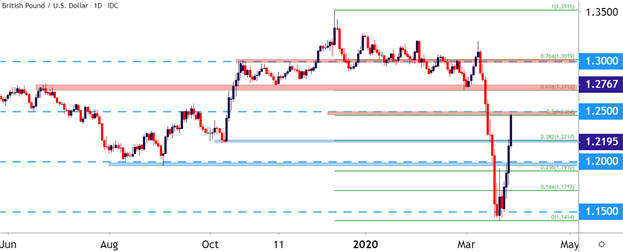

It was a big week for the British Pound. It was just last Friday that GBP/USD set a fresh 35-year-low, as a potent combo of both USD-strength and GBP-weakness pushed prices in the pair below the 1.1500 level for the first time since 1985. Buyers came back this week, however, and there was a bit of aggression in the move as GBP/USD rallied by more than 1,000 pips from those lows that were set just a week ago.

But it wasn’t just against the US Dollar that the Pound showed strength, as the currency also gained against both the Japanese Yen and the Euro, even as another risk factor flared with the UK now being shut down in the effort of stemming the spread of the novel coronavirus. The Bank of England has already hurried into action, similar to both the Fed and the ECB; but at this point it can be difficult to make long-term prognostications given the historical nature of the events before us. Below I parse through three of the more popular GBP-pairs with a look towards the week ahead.

GBP/USD: Extreme Moves, Extreme Volatility, Tread Quietly

Last week’s breakdown in Cable brought on fresh 35-year lows with the pair testing below the 1.1500 psychological level temporarily. That low was set last Friday; and in the week since a very different theme has taken hold as GBP/USD has rallied by more than 1,000 pips off of those lows.

With a move and backdrop carrying such an extreme nature, it can be difficult to project how prior iterations of technical criteria may help with future decisions; because, after all, if there are more reasons for buyers or sellers to crush prices through support or resistance, there’s less reason (and probability) for those levels to hold. This also means trend trading can be more challenging, as a potential reversal may be lurking around the next corner and range strategies can be utterly unattractive.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

This can, however, open the door to breakout or reversal scenarios as traders get even more risk averse with setups and more aggressive with managing positions. In GBP/USD, the forecast for next week will be set to neutral. On the below chart, a few nearby support and resistance levels are identified that hold interest ahead of next week’s open.

GBP/USD Technical Forecast: Neutral

GBP/USD Daily Price Chart

Chart prepared by James Stanley; GBP/USD on Tradingview

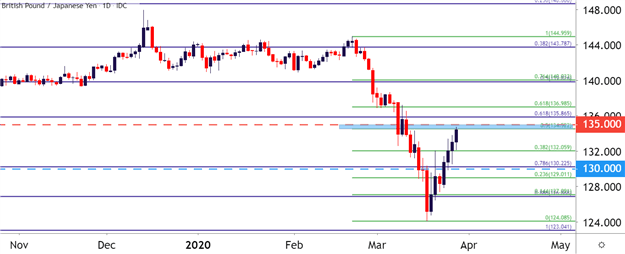

GBP/JPY Jumps From Three-Year-Lows

It was a bullish week in GBP/JPY, as well, albeit to a lesser degree given the extreme weakness that showed in the USD following the litany of historic actions out of the Federal Reserve. After dropping by more than 2,000 pips from late February into mid-March, the pair has clawed back 50% of that move, finding a bit of resistance at a key area on the chart. This area has a bit of confluence as the 50% marker of this recent major move aligns closely to the 135.00 psychological level.

| Change in | Longs | Shorts | OI |

| Daily | 1% | -3% | -1% |

| Weekly | 13% | -31% | -17% |

This can keep the pair as attractive for reversal scenarios, particularly for those looking to fade this week’s GBP-strength following the prior sell-off.

GBP/JPY Technical Forecast: Bearish

GBP/JPY Daily Price Chart

Chart prepared by James Stanley; GBP/JPY on Tradingview

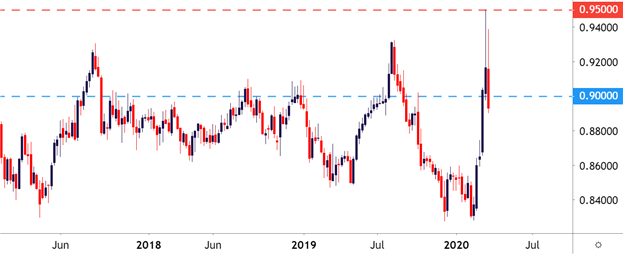

EUR/GBP Snaps Back from Decade Highs

EUR/GBP has similarly been in the midst of some fairly extreme volatility, and this is very evident from the weekly chart showing two very long, extended wicks atop recent price action.

| Change in | Longs | Shorts | OI |

| Daily | -4% | -2% | -4% |

| Weekly | -9% | 5% | -6% |

EUR/GBP Weekly Price Chart

Chart prepared by James Stanley; EUR/GBP on Tradingview

For traders looking at an extension of GBP-strength, EUR/GBP may fit the bill. The pair has just crossed back-below the .9000 big figure while also pushing below the 61.8% retracement of the recent major move. This can keep the pair as an attractive option for those looking at a continuation or extension of GBP-strength; looking to pick on the Euro as a potentially weaker currency.

EUR/GBP Technical Forecast: Bearish

EUR/GBP Four-Hour Price Chart

Chart prepared by James Stanley; EUR/GBP on Tradingview

--- Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX