S&P 500, DAX, FTSE 100 Analysis and News

- S&P 500 | Trend Remains Intact, Despite Bearish Signals

- DAX | Eyes on Key Trendline From Record Peak

- FTSE 100 | Weekly Close Above Trendline Keeps Uptrend Going

Looking for a fundamental perspective on Equities? Check out the Weekly Equities Fundamental Forecast.

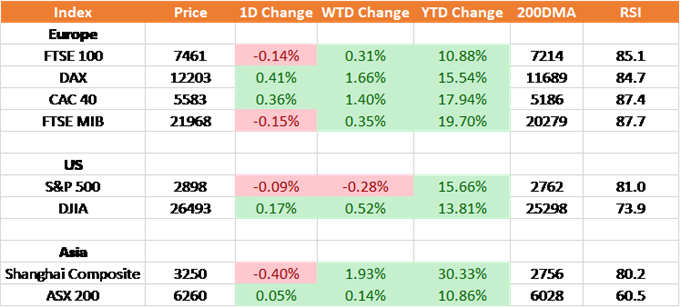

Source: Thomson Reuters, DailyFX

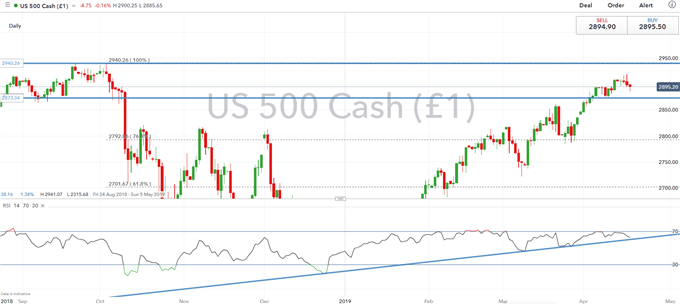

S&P 500 | Trend Remains Intact, Despite Bearish Signals

Gains in the S&P 500 began to ease following a test of 2920 with investors potential booking profits ahead of the Easter holiday. Despite the index trading back below 2900, questions remain whether the failure to break 2920 marks a reversal in the index, while short term indicators also continue to suggest a pullback is due. However, with volatility continuing to drop across multiple assets, trend following remains intact for now, thus keeping a move towards records highs within sight.

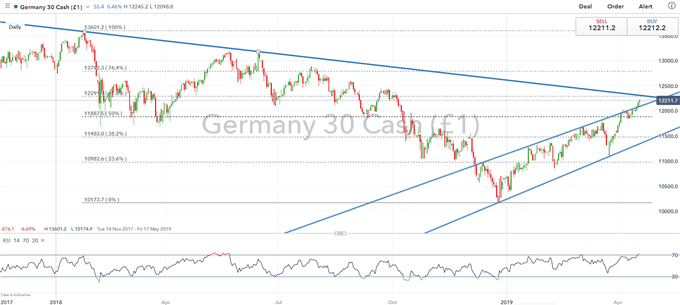

DAX | Eyes on Key Trendline From Record Peak

The upward momentum has continued for the DAX, which saw another strong week with the index breaking above the rising channel. Consequently, the index is now eying crucial resistance stemming the 61.8% Fibonacci retracement, which also coincides with the descending trendline from the Jan 2018 record high. With the index also hovering in overbought territory, profit taking may ensue on a test of 12300.

DAX PRICE CHART: DAILY TIME FRAME (Dec 2017 – Apr 2019)

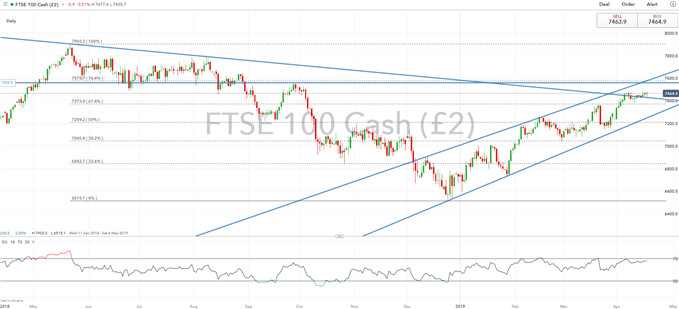

FTSE | Weekly Close Above Trendline Keeps Uptrend Going

This week saw somewhat sedate price action in the FTSE 100, eeking out marginal gains of 0.3%. However, with the index continuing to trade within the rising channel and making a weekly close above the descending trendline from the record high, the outlook remains modestly bullish for the FTSE 100. As such, this increases the likelihood of a test of topside resistance situated at 7500. On the downside, support is seen at 7420 before the 7390-7400 area.

RESOURCES FOR FOREX & CFD TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Other Weekly Technical Forecast:

Crude Oil Forecast: 50% Off the Lows � Can Bulls Continue Rally

British Pound Forecast: GBPUSD, EURGBP & GBPNZD

US Dollar Forecast: Big Test of Resistance Nearing

Gold Forecast: XAU at Support, Fresh 2019 Lows

Equities Forecast: S&P 500, DAX, FTSE 100 Technical Forecast