Gold Price Technical Highlights:

- Upward channel keeps gold moving higher (for now)

- A breakdown is seen as increasingly likely

Check out the DailyFX Trading Guides page for intermediate-term forecasts, educational content aimed all experience levels, and more!

Looking for a fundamental perspective on Gold? Check out the Weekly Gold Fundamental Forecast.

Upward channel keeps gold moving higher (for now)

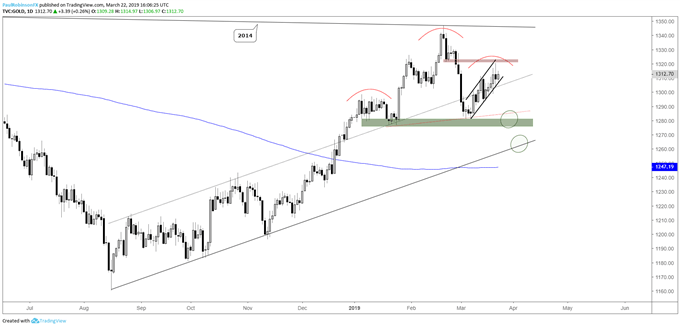

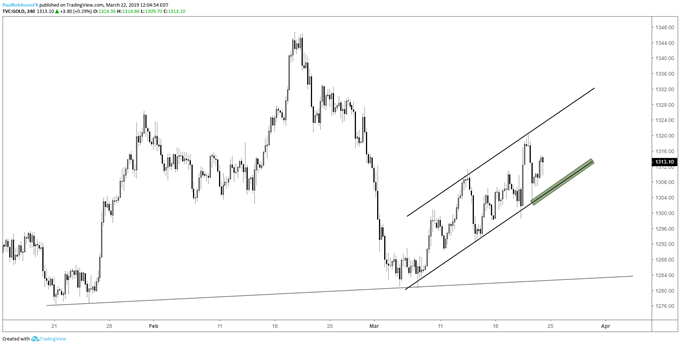

Gold continues its 2 steps forward, 3 steps back ‘rally’, if you can call it that. The upward grind has a clear channel structure coming into view, one which can be used whether you are operating form the long or short-side of the tape.

Overall, the grind smacks of a corrective move of the down-move off last month’s high, but as long as the lower parallel of the channel is respected then the short-term trend remains tentatively bullish. How high gold could go is hard to say with the way momentum is lacking. There is minor resistance around 1320/21.

A break, however, and things will likely change quickly. A drop through the lower parallel will bring into play the neckline of a head-and-shoulders pattern and a pair of lows surrounding 1280 that make up the neckline. It’s not the prettiest pattern, but sometimes it’s the semi-sloppy ones that work the best.

The immediate focus is on the channel. From a tactical standpoint, both longs and shorts can use the lower parallel as a guide for making decisions. These clean technical structures can be looked to for assessing downside risk on bullish bets and timing for would-be shorts seeking confirmation that momentum may have shifted lower.

Traders are long gold, see the IG Client Sentiment page to find out how changes in positioning could signal the next price move.

Gold Daily Chart (Broader view sports bearish outlook)

Gold 4-hr Chart (Watch channel for cues)

Helpful Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

Other Weekly Fundemental Forecasts:

Australian Dollar Forecast – AUD/USD Rebound Stalls Post-Fed

Oil Forecast – Evening Star Prints as $60 Breakout Fails

British Pound Forecast – British Pound Volatility Continues and a Break Is Inevitable

US Dollar Forecast – Is FOMC Scared of a Stronger DXY? Apparently So, As They Should