TECHNICAL FORECAST FOR THE EURO: BEARISH

- Monthly chart setup warns Euro vulnerable to prolonged decline

- Near-term downtrend intact through bounce from November lows

- Short EUR/USD position in play, looking for bearish resumption

See our free guide to get help gain confidence in your Euro trading strategy !

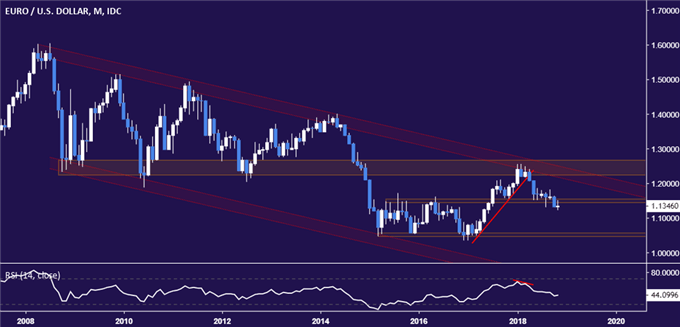

October ended with the Euro seemingly set to suffer deeper losses against the US Dollar. A look at the monthly chart reveals prices breached range top resistance-turned-support centered around the 1.15 figure – a pivotal inflection point since May 2015 – to suggest that a move toward a four-year range floor near 1.05 may well be in the cards in the months ahead.

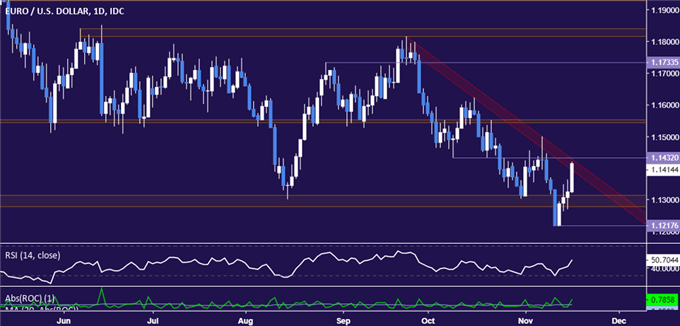

The bearish bias remains upon examination of more actionable positioning on the daily chart, but the setup is far less immediately actionable than it might seem at first glance. Prices are resting resistance guiding the downswing from the downswing started in late September. It is thus far unclear whether this barrier will hold and bearish is resumption is to follow or if a breakout will precede a larger upside retracement.

Resistance is now at 1.1432, with a break above that confirmed on a daily closing basis opening the door for a test of the 1.1543-54 inflection region. Alternatively, a turn back below the 1.1279-1.1314 zone paves the way for a challenge of the swing low at 1.1218. The absence of a bearish reversal signal or a clear-cut break makes it unclear which scenario might prevail however.

On balance, the short EUR/USD position triggered at 1.1708,then scaled up – first at 1.1468 and then again at 1.1242 – will remain in play for now. Adding further to exposure is a bit premature at this time however, with a defined bearish reversal signal and a breakdown that invalidates the series of higher highs and lows traced out over the past week needed for confirmation.

--- Written by Ilya Spivak, Sr. Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter

OTHER TECHNICAL FORECASTS:

Oil Forecast – US Oil Has Three Days of Stability Against Six Weeks and 30% Of Tumble

British Pound Forecast – Sterling Seeks Further Brexit News

US Dollar Forecast – Dollar Leans Towards Important Bearish Breaks, Will Liquidity Save It?

Equity Forecast – Technical Forecast for Dow, S&P 500, FTSE 100, DAX and Nikkei