EUR/USD Technical Strategy: SHORT AT 1.1648

- Euro breaks below 1.13 figure, exposes support in the 1.1110-32 area

- Test through 1.09 may follow further breakdown, 1.13 now resistance

- Modest upswing sought for better risk/reward to add to short position

See our Euro forecast to learn what is likely drive prices through year-end!

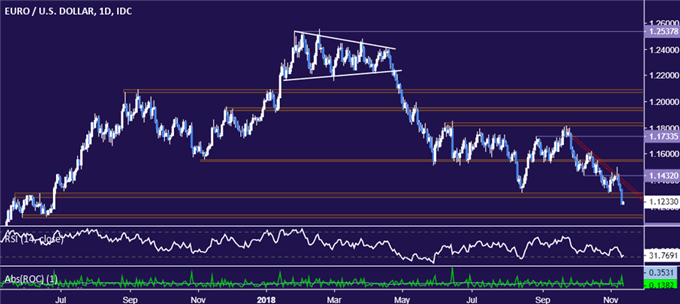

The Euro looks likely to suffer deeper losses against the US Dollar after dropping through support in the 1.1268-1.1301 area, hitting the lowest level in over 16 months. Prices accelerated downward after last week’s break of counter-trend support guiding a tepid upswing, as expected.

Form here, sellers are eying the next downside barrier in the 1.1110-32 zone, with a break below that confirmed on a daily closing basis exposing a minor barrier at 1.1024 (May 2017 high), followed by a more substantive threshold in the 1.0797-1.0863 region.

Alternatively, a reversal back above 1.1301 – likewise confirmed with a daily close – opens the door for another challenge of resistance at 1.1432. This level marks the intersection of a former support level as well as a falling trend line guiding the down move since late September.

The short EUR/USD trade activated at 1.1708 and subsequently scaled up at 1.1468 is still in play. Risk/reward considerations argue against adding to exposure immediately, so an entry order has been established to do so at 1.1242. A stop-loss will be triggered on a discretionary basis.

EUR/USD TRADING RESOURCES

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Trading Q&A webinar and have your questions answered

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To contact Ilya, use the comments section below or @IlyaSpivak on Twitter