GBP Analysis and Talking Points

See the DailyFX Q2 FX forecast to learn what will drive the currency throughout the quarter.

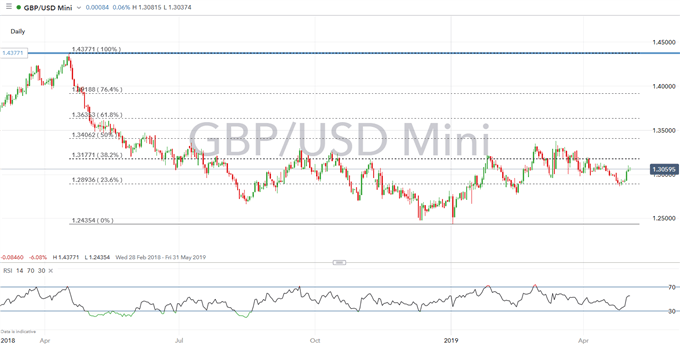

GBPUSD | 1.31 Break Needed to Fuel Further Upside

While the upside in the GBP has persisted, further gains has struggled at the 1.31 handle, where the 50DMA resides (1.3106). Momentum indicators are slightly bullish; however, this has eased amid the failure to make a decisive break above 1.31. Eyes will be on the BoE quarterly inflation report, in which a hawkish hold could fuel further gains in the Pound (full story). On the downside, near-term support sits at 1.3030, while a drop below exposes a move towards 1.2980 (100DMA).

GBPUSD PRICE CHART: Daily Time Frame (Feb 2018 – May 2019)

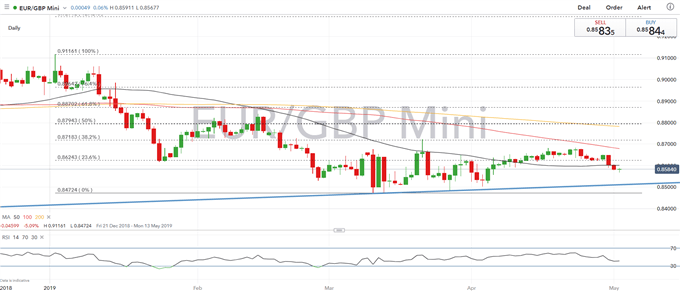

EURGBP | Risk of Wider Pullback, Support at 0.8550

Yesterday saw the cross close below its 50DMA (0.86), which in turn raises the risk of a wider pullback in EURGBP, momentum indicators (measured by DMI’s) are tilted to downside on both the short-term and longer-term studies. As such, eyes are on for a move towards 0.8550 after dropping to a fresh 4-week low of 0.8570. Any move higher, could struggle at the 0.86 handle.

EURGBP Price Chart: Daily-Time Frame (Dec 2018 – May 2019)

GBPUSD Price Outlook: More Gains Possible (Martin Essex, MSTA , Analyst and Editor)

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX