GBPUSD price analysis:

- GBPUSD has broken higher after trading within a bearish descending triangle chart pattern for the past two months.

- That suggests further gains to come, with IG Client Sentiment data also pointing to future strength.

Sterling outlook positive

GBPUSD traded for almost two months within a descending triangle pattern on the charts. That usually ends with a break to the downside, and that indeed happened. However, the price has now recovered all its losses and jumped above the resistance line joining the previous lower highs – suggesting further gains to come.

GBPUSD Price Chart, One-Hour Timeframe (March 4 – May 1, 2019)

Chart by IG (You can click on it for a larger image)

The price has also clambered above the psychologically important 1.30 level and, as the chart above shows, the 100-hour moving average is now close to crossing above the 200-hour moving average. If it does, that would be another bullish signal. Note too that the 14-hour relative strength index below the main chart is no longer above the 70 level signaling that the market has been overbought.

The next targets could well be the 1.3119 high touched on April 15, followed by the 1.3133 high reached on April 12, with support coming in at 1.30 and then around 1.2980, where the previous resistance line lies.

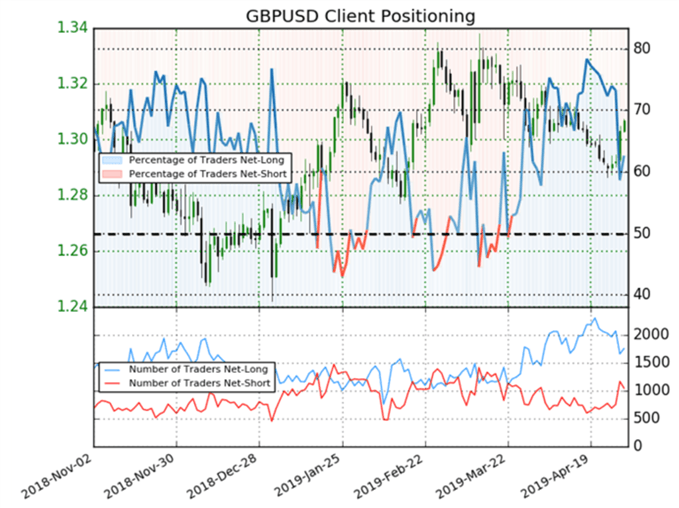

Bullish signal from IG Client Sentiment data

This positive technical picture is supported by IG Client Sentiment data. An analysis of where retail traders using IG are positioned shows 62.6% are net-long, with the ratio of traders long to short at 1.68 to 1. In fact, traders have remained net-long since March 26, when GBPUSD traded near 1.32058; the price has moved 1.0% lower since then. However, the number of traders net-long is 14.4% lower than yesterday and 17.7% lower from last week, while the number of traders net-short is 29.5% higher than yesterday and 51.5% higher from last week.

At DailyFX, we typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may fall back again. Yet traders are less net-long than yesterday and compared with last week, and these recent changes in sentiment back the view that the GBPUSD price may extend higher despite the fact traders remain net-long.

Source: DailyFX

If you’d like to learn more about using the IG Client Sentiment data, listen in to my weekly webinars every Wednesday at 1130 GMT (1230 BST). Our webinar calendar is here.

You can also find longer-term trading forecasts for GBP in the second quarter of the year here.

Resources to help you trade the forex markets:

Whether you are a new or an experienced trader, at DailyFX we have many resources to help you:

- Analytical and educational webinars hosted several times per day,

- Trading guides to help you improve your trading performance,

- A guide specifically for those who are new to forex,

- And you can learn how to trade like an expert by reading our guide to the Traits of Successful Traders.

--- Written by Martin Essex, Analyst and Editor

Feel free to contact me via the comments section below, via email at martin.essex@ig.com or on Twitter @MartinSEssex