COT Report – Analysis and Talking Points

The Predictive Power of the COT Report

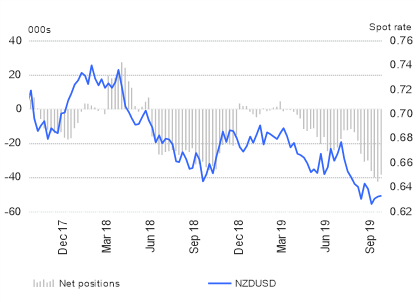

Source: CFTC, DailyFX (Covers up to October 8th, released October 11th)

Euro Shorts Increase Sharply, GBP/USD Less Bearish, USD Bulls Rise – COT Report

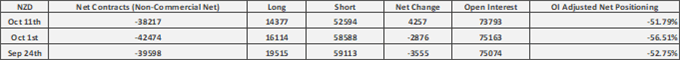

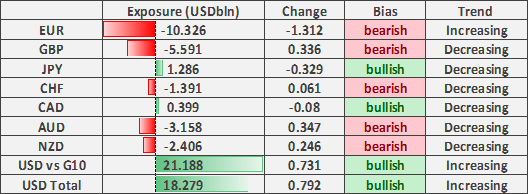

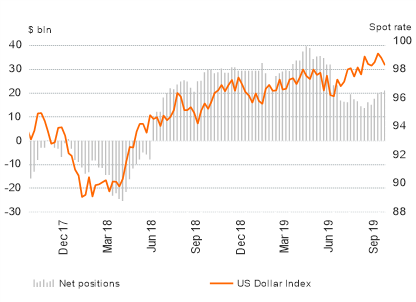

The latest CFTC positioning data showed that speculators boosted their USDnet long positions by $731mln vs G10 currencies with much of the increase attributed to the sizeable jump in Euro net shorts.

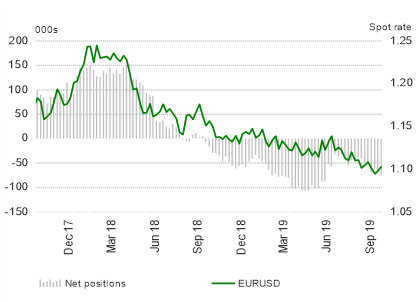

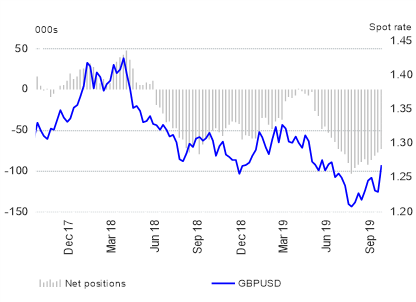

Sentiment in the Euro continued to deteriorate as speculators cut their gross longs by roughly 10k contracts, resulting in a $1.3bln increase in net shorts to over $10bln. Subsequently, bearish bets on the Euro are the largest since June. Elsewhere, investors had once again pared their Sterling net shorts, cut by $336mln to $5.59bln. That said, despite the substantial rally seen last week following the Brexit breakthrough, there is further room to run for the Pound on short covering, provided that an amended deal can be passed through parliament before the October 31st Brexit date.

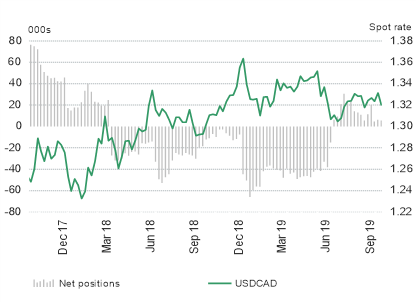

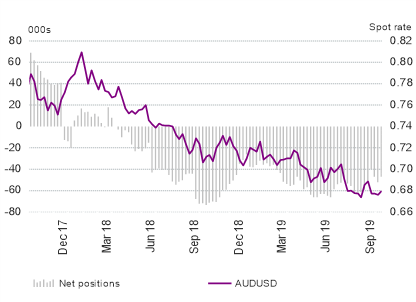

Across the Antipodean currencies, investors had cut back on their AUD and NZD net short positions, however, while the latter posted its first reduction in 4-weeks, positioning remains extreme, thus risks for the Kiwi remain asymmetrically tilted to the upside. Investors remained somewhat indecisive on the Canadian Dollar with positioning relatively unchanged from the prior week at $399mln.

US Dollar

GBP/USD

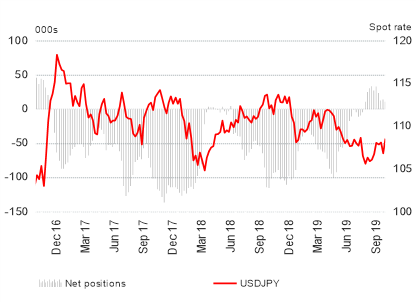

NZD/USD