CoT Highlights:

- No really notable changes, recent relative extremes persist

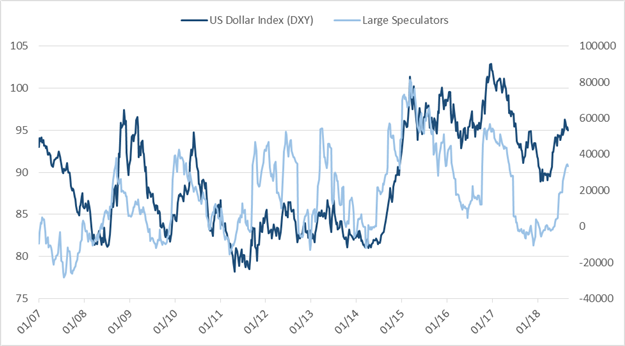

- USD traders took a break from buying, snapped 18-week streak

- Large spec profiles for major currencies and markets

For a timelier indicator of sentiment in major currencies and markets, see the IG Client Sentiment page.

Friday’s report wasn’t particular eventful, with no major changes in market positioning. Large dollar speculators finally took a break from adding to their bullish exposure, snapping the 18-week streak of net-purchases. The largest change in FX was in the euro contract, where net positioning flipped back to long by nearly 8k contracts.

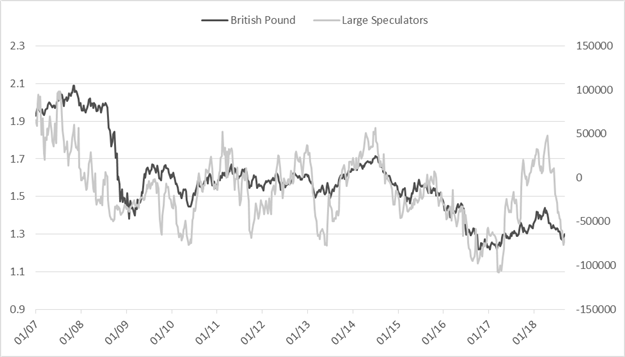

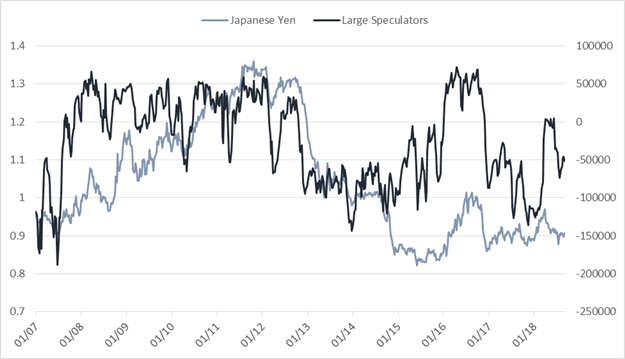

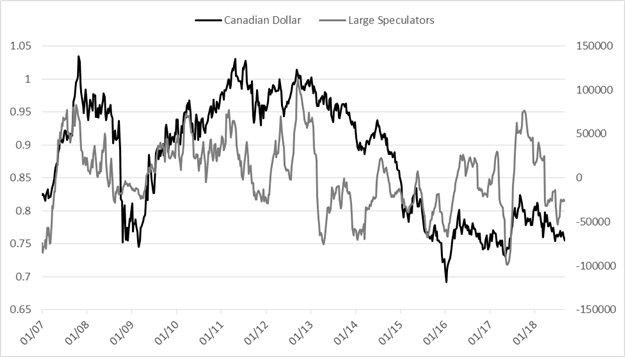

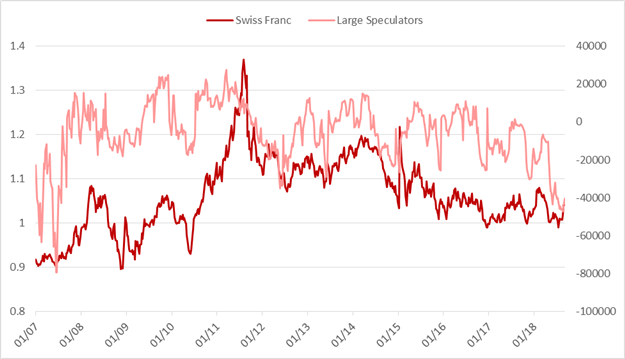

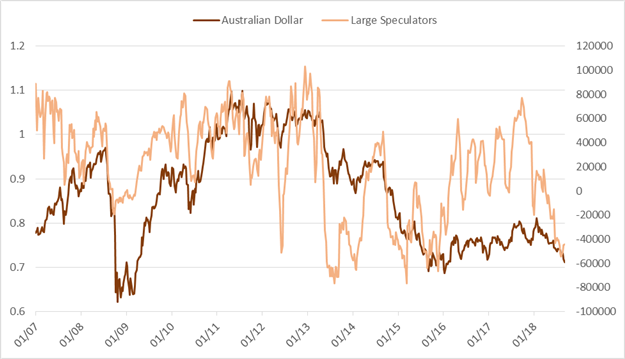

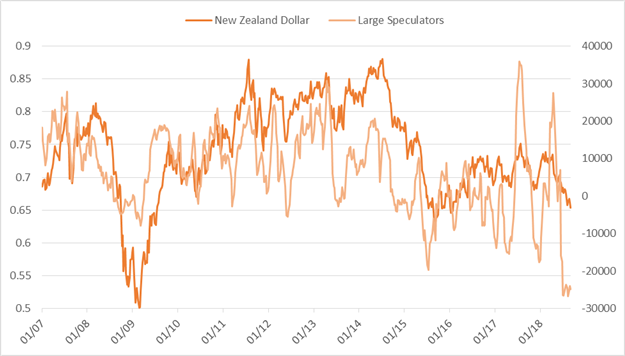

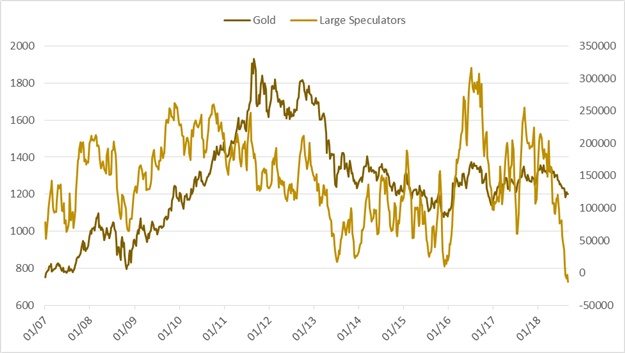

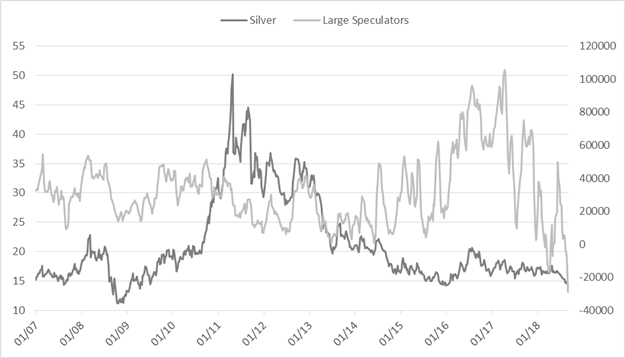

British pound, Canadian dollar, Swiss franc, and Australian dollar large specs also saw net-buying, while shorts were added to Japanese yen and New Zealand dollar positions. Precious metal contracts saw more selling, with both gold and silver extending further into net-short territory. Large specs recently turned net-short gold for the first time since August 2002.

Generally speaking, USD-bullish bets remain intact and relatively extreme when looking back over recent history; EUR, CHF, AUD, NZD, and GBP positions are in the bottom 20% of their 52-week range, with CHF coming off an extreme not seen since 2007 and AUD since 2015. If the dollar is to continue to rally we may see a little more digestion and retraction in bullish sentiment first.

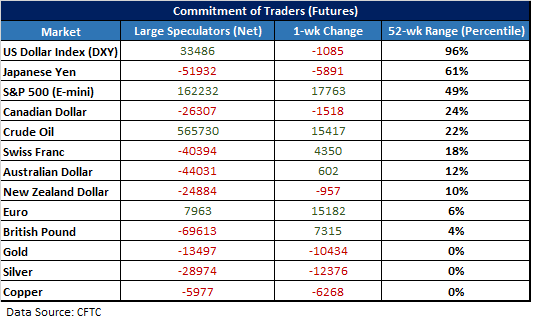

Every Friday the CFTC releases a detailed report of traders’ positioning in the futures market as reported for the week ending on Tuesday. Outlined in the table below are key stats concerning the positioning of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders largely employ trend-following strategies, and as such, their net long exposure typically increases in uptrends while net short positioning increases in downtrends. When analyzing the data, we take into consideration the direction of their position, magnitude of changes, as well as extremes.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

See what fundamental and technical drivers are at work this quarter in the Q3 Trading Forecasts.

Large speculator profiles for major FX & markets:

US Dollar Index (DXY)

Euro

British Pound

Japanese Yen

Canadian Dollar

Swiss Franc

Australian Dollar

New Zealand Dollar

Gold

Silver

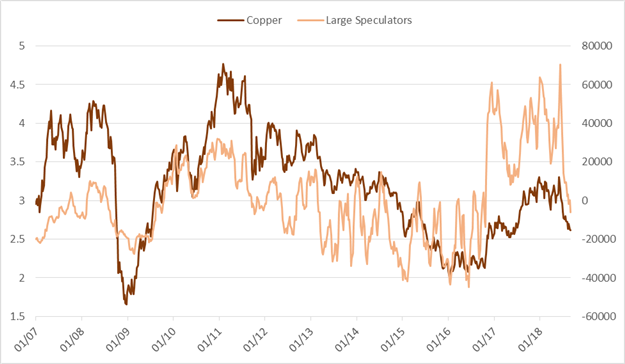

Copper

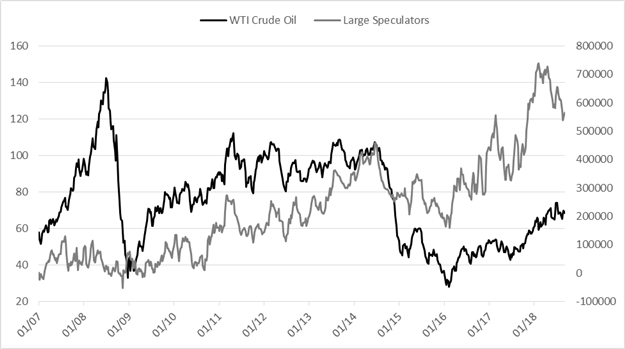

Crude Oil

S&P 500 (E-mini)

Resources for Forex & CFD Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX