CoT Highlights:

- Large speculators add to euro long, furthering their record position

- Crude oil positioning continues to push to new historical extremes

- Futures positioning charts for other key FX-pairs and markets

The CoT report is longer-term sentiment indicator; for short-term sentiment indications see the IG Client Sentiment page.

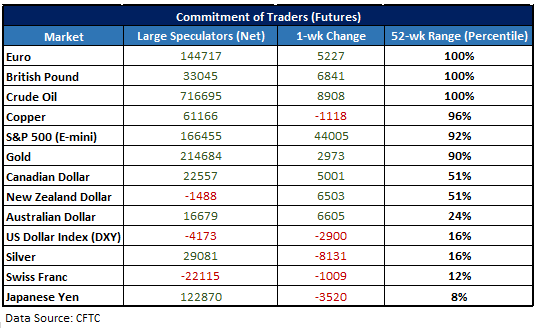

The most recent Commitment of Traders (CoT) report showed large speculators, in most instances, adding to net-positions which are already extreme relative to the past year. Seven of the 13 futures contracts highlighted below have position sizes which are in the top or bottom 10%. Last week we talked about GBP and gold, this week we’ll look at the euro and Oil.

Every Friday, the CFTC releases the weekly report showing traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below, we’ve outlined key statistics regarding net positioning of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders are largely known to be trend-followers due to the strategies they typically employ, collectively. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing how their activity could impact future price fluctuations.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

Euro large speculators keep adding to long position

This past week’s report showed large trend-followers adding to their net-long for the 6th week out of the past eight. The net-change of 5227 brings the total long position to 144.7k contracts, another record.

While large speculators have a solid track record of successfully identifying intermediate to long-term trends in the euro, there is reason to believe they could be getting ahead of themselves. Turning to the monthly chart, the euro is at a trend-line extending down from 2008. Big resistance coupled with an extreme level of bullishness could keep EUR/USD from trading higher.

Chart 1 – Euro Positioning

Chart 2 – EUR/USD: Monthly

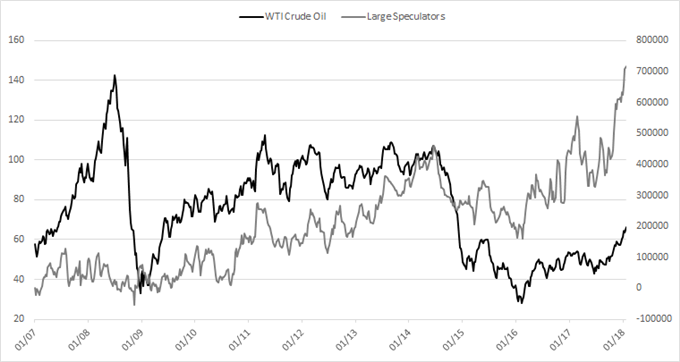

Crude oil speculative positioning continues pushing to new extremes

Large oil traders continue to add to their speculative long, adding another 8908 contacts to bring the total to +717k. Just as impressive as the rally has been, so has the addition to the total net-long positioning. Twelve out of the past 15 weeks we have seen an increase in long exposure, and while it is at a record extreme, it has clearly meant nothing in terms of indicating an overbought market.

We will continue run with price action first, positioning second. Should we see price action turn bearish (lower lows, lower highs), then an unwinding of longs will be seen as an accelerant to a trend reversal. But until that happens, as they say, “the trend is your friend.” There is resistance in the vicinity of 67-71, created during late-2009 through most of 2010; worth keeping an eye on as oil heads into this zone.

Chart 3 – Crude Oil Positioning

Chart 4 – Crude Oil Price: Weekly

To see how sentiment could tie into our outlook on FX pairs and markets, check out the DailyFX Q1 Forecasts.

Large speculator profiles:

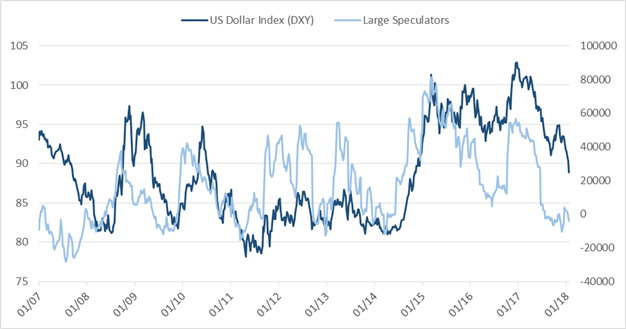

US Dollar Index (DXY)

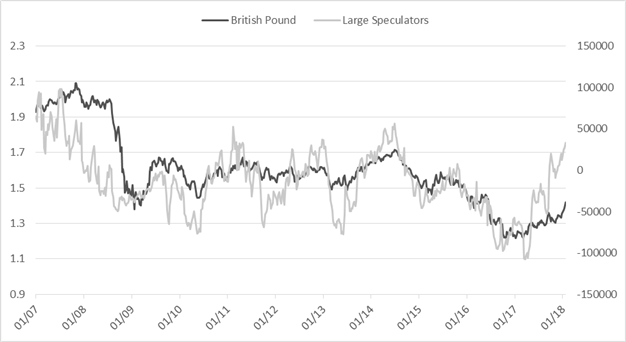

British Pound

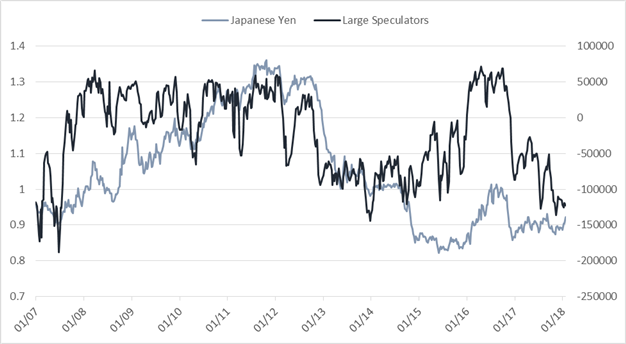

Japanese Yen

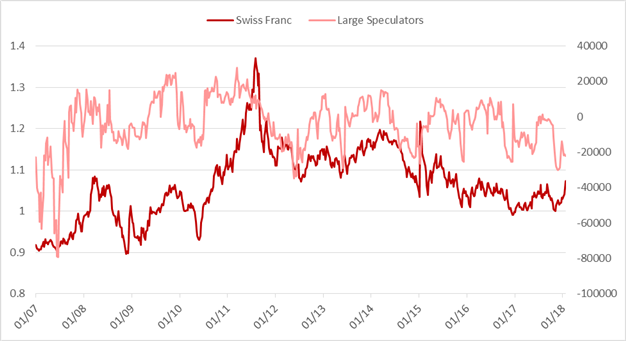

Swiss Franc

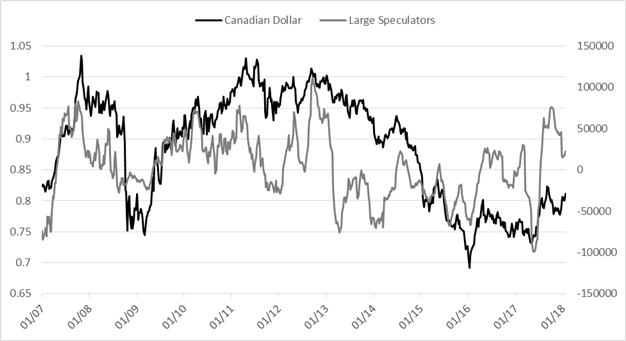

Canadian Dollar

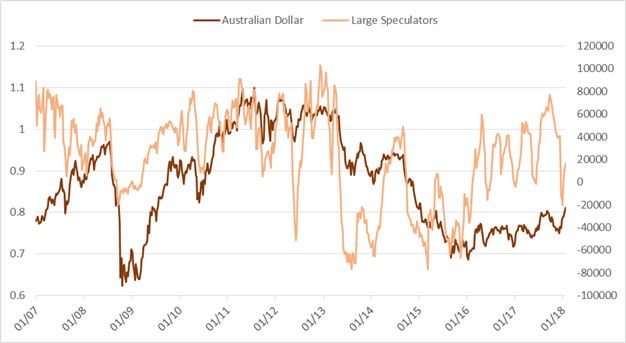

Australian Dollar

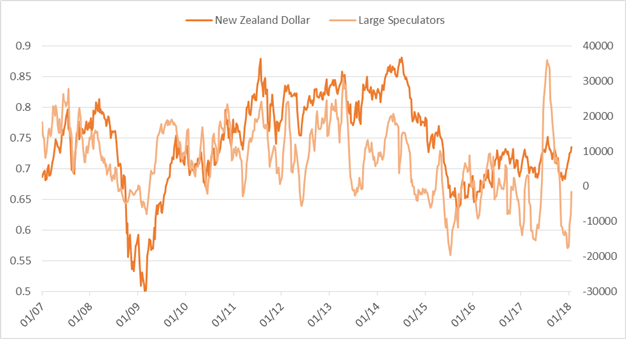

New Zealand Dollar

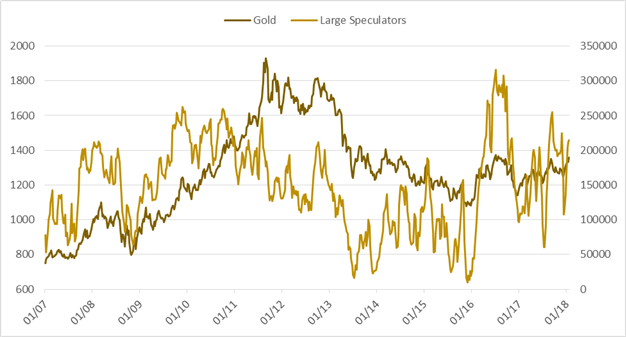

Gold

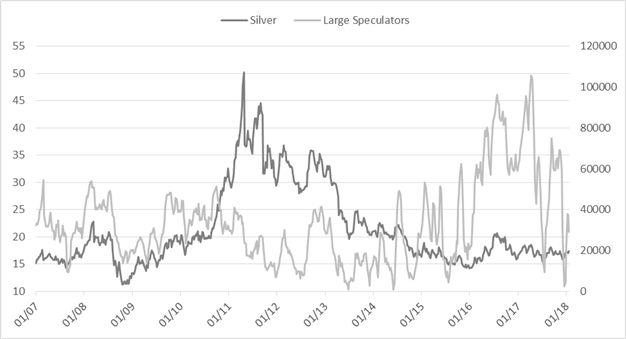

Silver

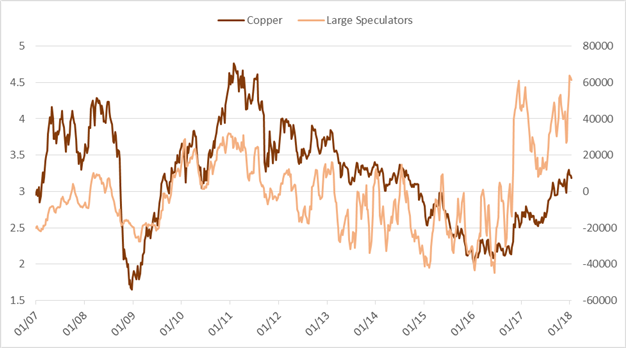

Copper

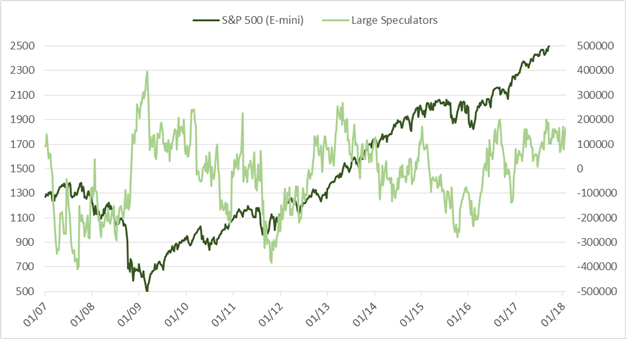

S&P 500 (E-mini)

Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help improve performance, and a guide specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX