CoT Highlights:

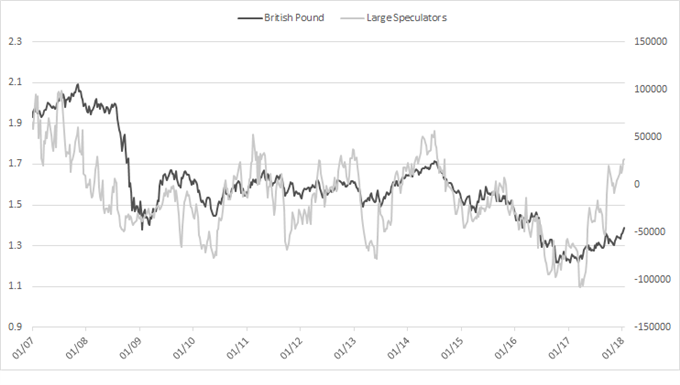

- Large speculators long most GBP contracts since July 2014

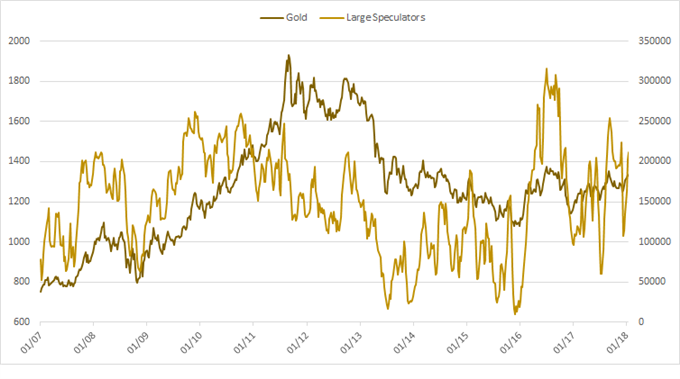

- Large specs add to net-long in gold for 5th week in a row, historically large

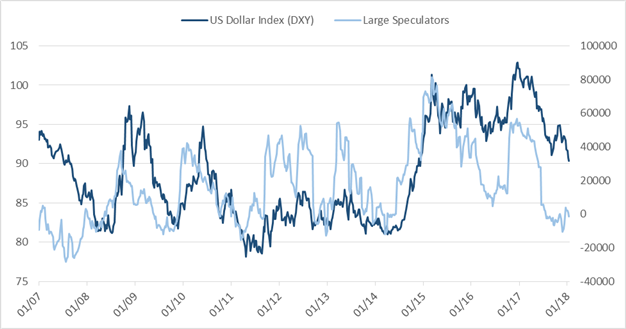

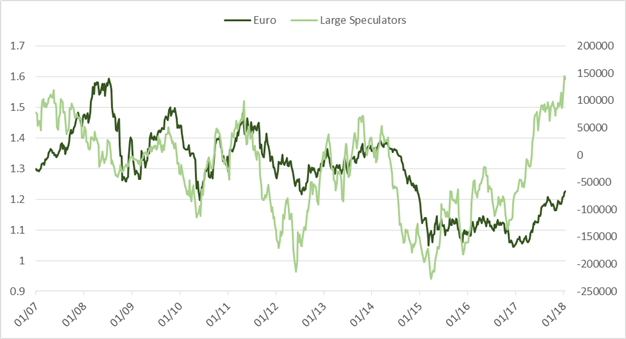

- Futures positioning for other key FX-pairs and markets

The CoT report is longer-term sentiment indicator; for short-term sentiment indications see the IG Client Sentiment page.

The most recent Commitment of Traders (CoT) report showed large speculators adding to their net-long in GBP established at the beginning of December, with the current holding the largest since 2014. Gold large specs increase net-long for 5th week in a row, becoming a big position by historical standards.

Every Friday, the CFTC releases the weekly report showing traders’ positioning in the futures market as reported for the week ending on Tuesday. In the table below, we’ve outlined key statistics regarding net positioning of large speculators (i.e. hedge funds, CTAs, etc.). This group of traders are largely known to be trend-followers due to the strategies they typically employ, collectively. The direction of their position, magnitude of changes, as well as extremes are taken into consideration when analyzing how their activity could impact future price fluctuations.

Key stats: Net position, one-week change, and where the current position stands relative to the past 52 weeks.

GBP large specs longest in 3 ½ years

This past week’s report, showed large speculators adding over 700 contracts to their net-long, which isn’t a big one-week change, but at +26,204 the position represents the largest position since July 2014. It’s not an enormous net position, and so far buyers have been correct since flipping long in early December for the first time since the summer of 2014.

Large speculators have a solid long-term track record of identifying intermediate to long-term trends, and for now until we see a change in trend the outlook from a positioning standpoint remains a neutral to positive factor.

British Pound

Gold longs add for a 5th week in a row

Last week represented the 5th week in a row that large speculators added to their net-long. At 211,711 contracts, the current position ranks in the top 16% in terms of size, historically. Just as traders appear to have capitulated during the December decline, they appear to have become too optimistic too fast during the most recent rise.

While the unloading of contracts relative to the decline was more dramatic, there is reason for caution here not only from a positioning standpoint, but from a pure technical view as well. There is trend-line resistance from 2013 which just last week put a lid on the advance. We may soon see gold trade back lower if it can’t soon cross above this threshold.

Chart 1 – Gold Positioning

Chart 2 – Gold Price: Weekly

Check out these 4 ideas for Building Confidence in Trading

Large speculator profiles:

US Dollar Index (DXY)

Euro

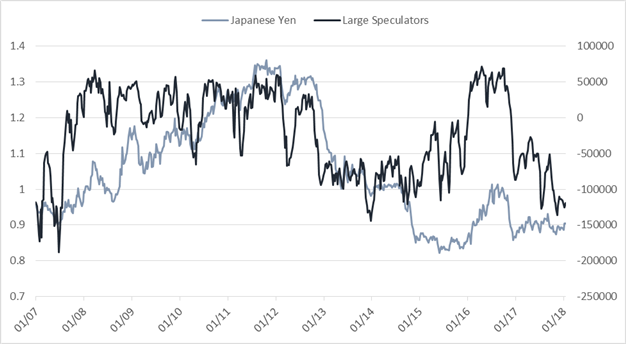

Japanese Yen

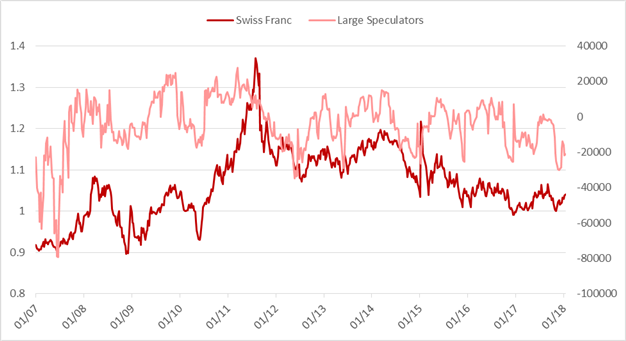

Swiss Franc

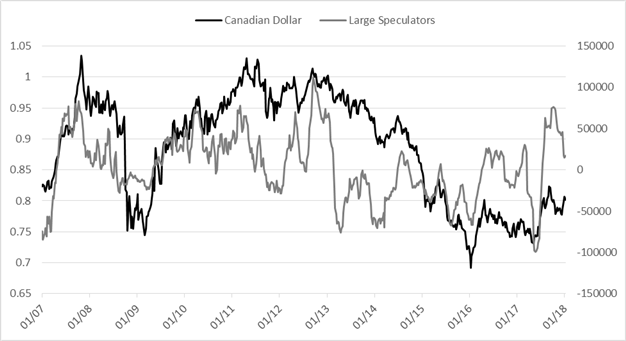

Canadian Dollar

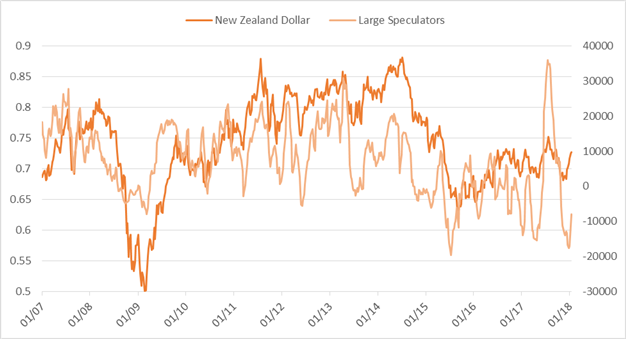

New Zealand Dollar

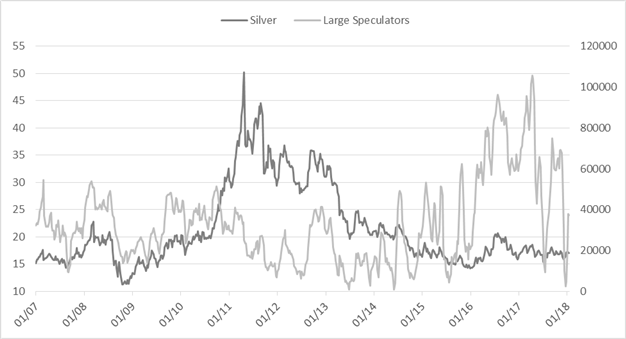

Silver

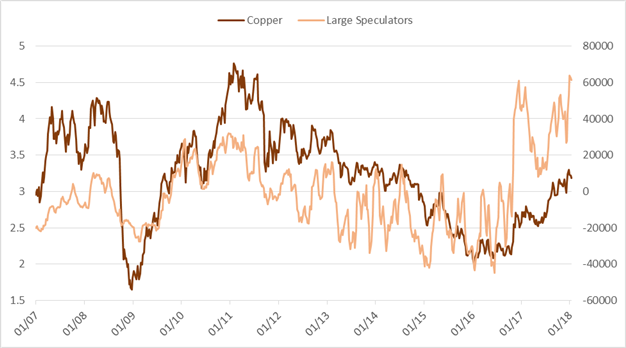

Copper

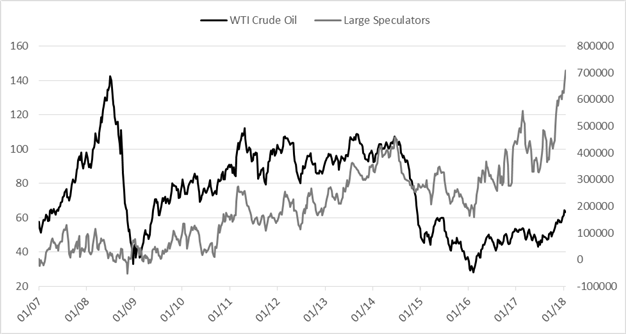

Crude Oil

S&P 500 (E-mini)

Trader Resources

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve performance, and a guide specifically for those who are new to forex.

---Written by Paul Robinson, Market Analyst

To receive Paul’s analysis directly via email, please SIGN UP HERE

You can follow Paul on Twitter at @PaulRobinsonFX