- Eurozone Industrial Production Jumped in June.

- Rhine River Levels Remain a Concern.

- European Power Prices Reach Record and Energy Crisis Deepens.

Understanding Inflation & its Global Impact

DAX 40: In Need of a Catalyst to Clear Key 14000 Level

The DAX rallied higher in early European trade creating a new weekly high of 13811 before a slight pullback as we approach the US market open. The index is enjoying a bullish week thus far boosted by softer US CPI numbers. The buoyant market sentiment post CPI has since been tempered somewhat by Federal Reserve members who were quick to stress that price pressure remains intense necessitating the need for further rate hikes. This view was echoed yesterday by Federal Reserve member Mary Daly who stated that a 75 basis point hike in September remains a possibility.

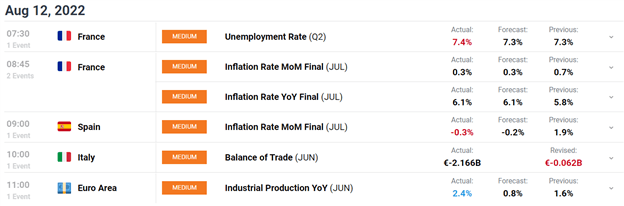

The early gains on the index could in part be attributable to a surprise jump in Eurozone industrial production in June. The June data for industry looks rather upbeat at face value with growth for a third month in a row and production at the highest level since December 2017. This means that industrial production contributed positively to GDP in the second quarter. However, with backlogs of work shrinking and new orders falling, there is not much reason for optimism in the months ahead. Inflation data from the black was mixed, with France and Spain offering differing pictures, as French CPI climbed 0.3% in the month in July while Spanish CPI fell by the same amount.

For all market-moving economic releases and events, see the DailyFX Calendar

Despite the positivity and resilience displayed by the index the outlook for Europe and its most industrialized economy does not bode well. Power prices across Europe rose on Thursday as a heatwave limits supply and wildfires rage in France. Benchmark German power rose by 6.6% for next year on the European Energy Exchange AG, reaching a record 455 euros per Megawatt-hour. The heatwave has intensified demand while supply challenges coupled with the drying up of the Rhine River among others on the continent which are used to ship energy commodities, the economy on the continent remains fragile. This was echoed by Germany’s Federal Minister of Finance Christian Lindner’s warning and worry as major power utility Uniper SE has already warned that Germans are set to face an “enormous wave” of rising energy costs in 2023. This is reflected in the ever-changing sentiment in markets as data releases are digested.

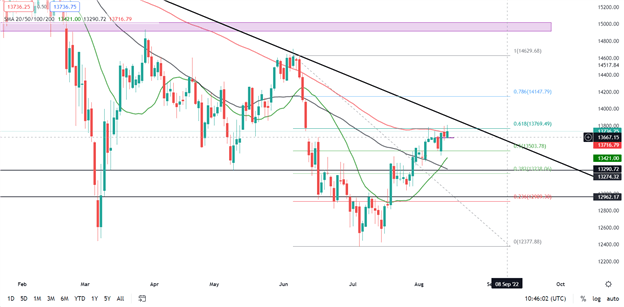

With strong technical roadblocks just above the current price, any immediate gains could be capped. The 14000 psychological level has a host of confluences and a sustained break above (either a daily or weekly candle close) at this stage seems unlikely without any significant catalyst. Something in a similar mode to the softer US CPI print on Wednesday.

Introduction to Technical Analysis

Trade the News

Recommended by Zain Vawda

DAX 40 Daily Chart – August 12, 2022

Source: TradingView

From a technical perspective, a daily candle close above 13605 will see us post four consecutive weeks of bullish price action and higher prices. With each week we have seen gains diminish as we seem to be reaching exhaustion and the potential for a pullback on the larger timeframes remain. The psychological 14000 level presents a host of confluences including the 61.8-76.4% fib retracement level, trendline resistance as well as the fact that we have traded below the level since the 10th June 2022. Today’s weekly and daily candle close will provide us further clues on a potential move going forward.

DAX 40 1H Chart – August 12, 2022

Source: TradingView

On a 1H chart, we have seen a bullish bounce from the 13650 support level supported by the 50- and 100-SMAs as well. The rally which continued into the European session saw us create a new weekly high however failing to see a 1H candle close above. Since creating the new weekly high we closed below the 61.8% fib level and have since retreated around 70 points. We have the key psychological 14000 level up ahead and may see a pullback towards the 13675-13700 level before moving higher. A 1H candle close below 13650 could open up a deeper pullback and would mean a change of 1H structure to bearish.

Introduction to Technical Analysis

Technical Analysis Chart Patterns

Recommended by Zain Vawda

Key intraday levels that are worth watching:

Support Areas

•13650

•13500

•13275

Resistance Areas

•13800

•13950

•14156

| Change in | Longs | Shorts | OI |

| Daily | -9% | 7% | 2% |

| Weekly | -27% | 9% | -5% |

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda