JULY INFLATION KEY POINTS:

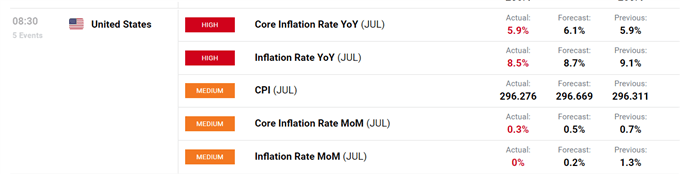

- July U.S. inflation was unchanged month-over-month, well below consensus estimates calling for a 0.2% increase. Compared to one year ago, headline CPI eased to 8.5%, versus 8.7% expected

- Core CPI advanced 0.3% on a seasonally adjusted basis and 5.9% in the last 12 months

- Weakening inflationary pressures are encouraging, but may not be enough to trigger a Fed’s monetary policy pivot in the near term

Trade Smarter - Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Most Read: US Dollar Price Action Setups - EUR/USD, GBP/USD, USD/CAD, USD/JPY

Updated at 9:10 am ET

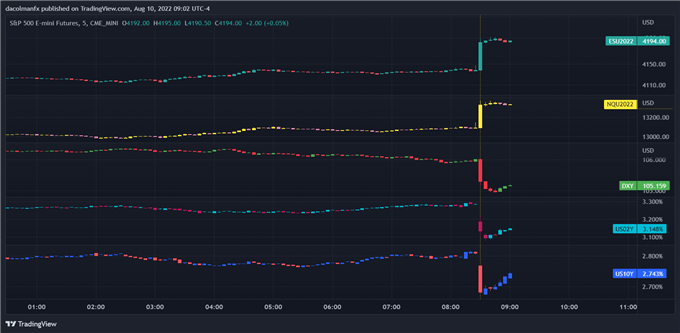

MARKET REACTION

Immediately after the CPI report crossed the wires, U.S. Treasury yields plunged on bets that the rapid slowdown in U.S. inflationary pressures may require less aggressive monetary policy tightening by the Federal Reserve. The sharp pullback in bond yields triggered a significant bearish reaction in the dollar, prompting the DXY index to slump more than 1.1% at the time of writing.

On the other hand, risk assets rallied violently. For example, S&P 500 futures jumped more than 1.7% in the pre-market session. Contracts linked to the Nasdaq 100 soared more than 2%. While the data may not yet lead to a Fed pivot, traders are beginning to price a shallower tightening cycle, with the odds of a 75 basis point hike in September sharply reduced in favor of a more measured 50 basis point increase.

S&P 500, NASDAQ 100, US DOLLAR CHART

Original post at 8:40 am ET

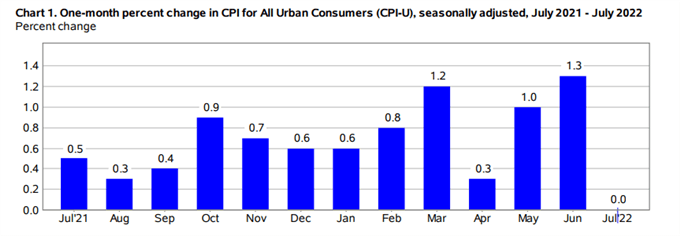

Inflationary pressures in the United States moderated at a rapid pace last month in response to a slump in energy costs following a large downward correction in the oil marke t, providing a respite for U.S. households, who have seen their purchasing power eroded and their paychecks diminished by the staggering price increases witnessed earlier in the year.

According to the U.S. Bureau of Labor Statistics, the consumer price index, which measures how much Americans pay for a representative basket of goods and services, flatlined (0.0%) on a seasonally adjusted basis in July after having surged 1.3% in June, delivering a positive surprise to Wall Street analysts and coming well below consensus estimates of a 0.2% rise.

Source: US Bureau of Labor Statistics

Compared to one year ago, headline CPI eased to 8.5%, slightly below the 8.7% expected, but sharply down from the 9.1% recorded at the end of the second quarter. The pullback in the annual reading represents a step in the right direction in the fight to restore price stability, a protracted process that would involve bringing inflation back to the Federal Reserve’s 2% target over the forecast horizon.

Focusing on the report’s details, food prices swelled 1.1% month-over-month following a 1.0% jump in the preceding period, registering another strong gain, a discouraging development for low-income families who spend a large portion of their wages on basic necessities.

Meanwhile, energy costs slumped 4.6% on the back of a 7.7% plunge in gasoline prices, offsetting higher costs for other items. Fuel has continued a downward trend in August, with average gasoline prices in the country down for the eighth consecutive week, suggesting that the energy expenditure category will have another large negative contribution to topline inflation in the next report.

Source: DailyFX Economic Calendar

Excluding food and energy, the so-called core CPI, which reflects longer-term trends in the economy and reduces noise by removing volatile components from the calculation, advanced 0.3% on a seasonally adjusted basis, two tenths of a percent below estimates, with gains driven by shelter and medical services, which moved up 0.5% and 0.4% respectively. With this result, the annual core inflation gauge remained unchanged at 5.9%, a better than projected figure.

On balance, there are encouraging signs that inflationary forces may be softening, although the improvement is not significant enough for a monetary policy pivot. The Fed has indicated time and again that it needs to see compelling evidence that overall prices are coming down meaningfully to consider altering its roadmap. Today's CPI data, while positive, may not meet the criteria for abandoning the hawkish tightening path, suggesting that the FOMC is likely to follow through with its plans to raise interest rates at all remaining meetings this year.

Related: The CPI and Forex: How CPI Data Affects Currency Prices

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG's client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

---Written by Diego Colman, Market Strategist for DailyFX