AUD/USD Analysis and News

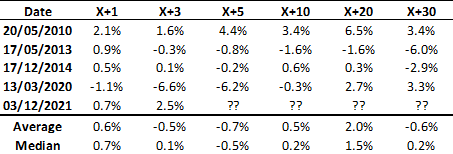

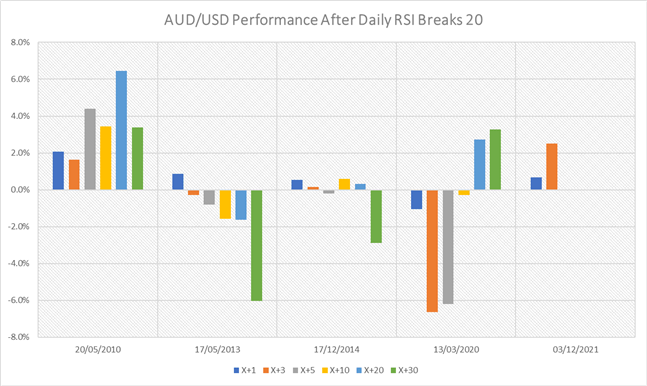

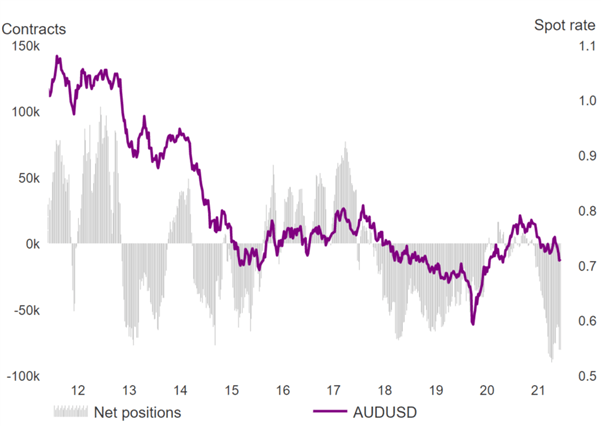

Earlier in the week, I noted the extreme oversold conditions in the Australian Dollar as the daily RSI crossed 20. Below (Figure 1.) shows the performance in the AUD/USD over the following three sessions. In turn, the currency has been among the main beneficiaries amid the rebound in risk appetite. What’s more, with net shorts in the Aussie hovering around a record peak (Figure 2.) position squaring has also played a big part in the recovery, leading to outperformance relative to other cyclical currencies.

However, following a sizeable 2.5% increase in the AUD, I suspect the currency will start to consolidate with topside hurdles from 0.7190-0.7210. To add to this, it is under a week until the FOMC rate decision, adjustments in positioning ahead of the event may see the USD retain a bid

.

Figure 1. Position Squaring Sees AUD/USD Outperform

Source: Refinitiv, DailyFX (X+1 = 1-day after AUD/USD RSI crosses 20)

Figure 2. AUD Net Shorts Hovering Near Record Peak

Source: Refinitiv

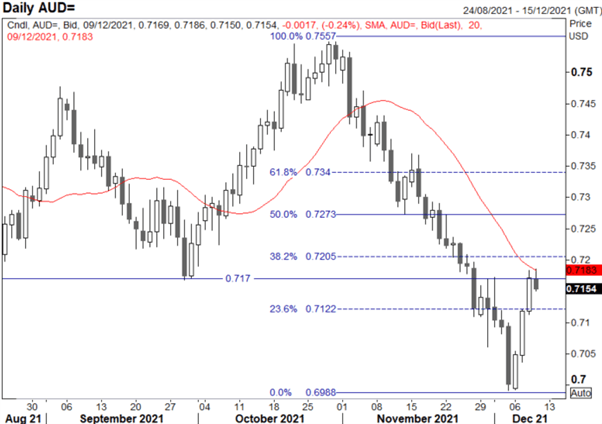

Taking a look at the chart, with risks of a modest pullback from the sizeable appreciation, short term support is situated at 0.7122, marking the 23.6% fib of the October to December drop. That said, with little on the economic calendar ahead of tomorrow’s CPI report, risk appetite is likely to dictate the latest state of play.

Source: Refinitiv