AUD/USD, EUR/GBP Analysis and News

AUD: During Friday’s the daily RSI on AUD/USD cracked through 20, a rare occurrence, which highlights just how extreme the move on the downside has been for the pair. When looking at the RSI, I tend to focus on the indicator when it is at extremes or divergences occurs, not simply when the indicator crosses 30 or 70. When at extremes, the RSI can be a great tool when looking for reversals, which was the case when I looked at the extreme upside in AUD/JPY back in October and since hitting the reversal trigger, the cross fell 6%.

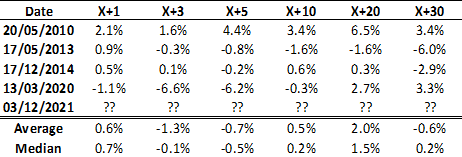

Looking at AUD/USD, the daily RSI has only broken below 20 on five occasions (including last Friday), therefore it is worth noting that the sample size is very small. The question is now, is that with AUD/USD heavily oversold, and positioning data showing Aussie net shorts at a fresh record peak, is the bad news now priced into the currency. In the short term, this will largely be dependent on the risk appetite and given the recent move to 4500 for SPX, I am somewhat neutral on the risk sentiment. Taking a look at the data, the results are relatively mixed. However, if you have a buy the dip mentality for risk appetite, it may be better to express this view via AUD/USD as opposed to SPX.

Source: Refinitiv, DailyFX (X+1 = 1-day after AUD/USD RSI crosses 20)

EUR/GBP: The bias for EUR/GBP remains to fade GBP weakness as the cross approaches the 200DMA. Doubts over a December BoE rate rise has increased after Friday’s cautious comments from BoE’s Saunders, who is typically seen as the most hawkish member of the MPC. The rate setter noted that there may be an advantage in waiting for more information on the Omicron variant before deciding to adjust policy settings. Additionally, Saunders stated that he sees a limited increase in the Bank Rate, which is in stark contrast to OIS markets pricing in near 1% interest rates by the end of 2022. This saw the probability for a December rate hike fall from 50% to 30%, with scientific data on omicron seemingly another condition for a rate rise. In turn, the focus for GBP traders will be on BoE’s Broadbents comments, scheduled for 11:30GMT.

EUR/GBP Chart: Daily Time Frame

Source: Refinitiv