Euro Sterling (EUR/GBP) Price, Chart, and Analysis

- Bank of England is likely to stand pat on policy measures.

- EUR/GBP continues to press down on support.

- Retail traders remain long EUR/GBP but the outlook looks mixed.

The Bank of England (BoE) will announce its latest policy decision today at 12:00 BST alongside its latest minutes and updated economic forecasts in its Monetary Policy Report. While policy settings are set to be left untouched, the main focus of the meeting will be on any divisions within the MPC on recalibrating the bond-buying program and how the committee perceives current, and future, inflationary trends. The central bank is likely to show caution and repeat that significant progress is needed before the stimulus program is trimmed, while also looking through the current level of inflation.

Bank of England Preview: How Will the Pound (GBP) React?

Keep up to date with all market-moving data releases and events by using the DailyFX Calendar

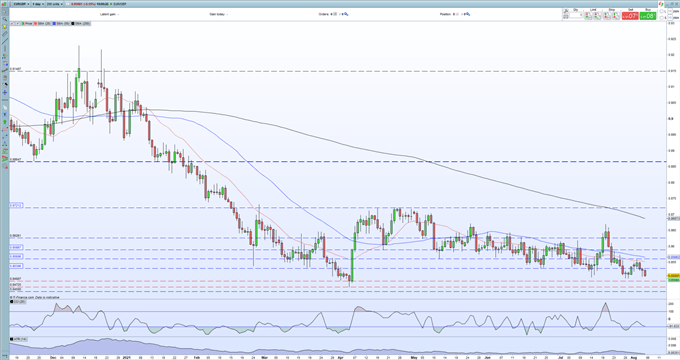

EUR/GBP is now testing support around the 0.8500 area, a level that has held a handful of attempts over the last three weeks. A confirmed break below here opens the way to the April 5 low at 0.84725, before levels last seen in February 2020 come into play. A complete breakdown in EUR/GBP, perhaps driven by a hawkish twist at today’s meeting, may eventually set the pair up for a re-test of the December 2019/February 2020 double low around 0.82770. The pair continue to respect overhead pressure from all three simple moving averages, while the CCI indicator hints at the pair entering oversold territory. A neutral BoE outcome may see the pair press marginally higher, but any upside move is likely to be limited and short-lived.

EUR/GBP Daily Price Chart (November 2020 – August 5, 2021)

Retail trader data show 73.59% of traders are net-long with the ratio of traders long to short at 2.79 to 1. The number of traders net-long is 6.13% higher than yesterday and 12.61% lower from last week, while the number of traders net-short is 10.90% lower than yesterday and 12.16% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/GBP prices may continue to fall.Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/GBP trading bias.

| Change in | Longs | Shorts | OI |

| Daily | 28% | -17% | 7% |

| Weekly | 15% | -3% | 8% |

What is your view on Euro Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.