Bitcoin (BTC/USD) Price Update:

- Bitcoin (BTC) surges to six-week high as US earnings provide a glimmer of hope for major cryptos

- Speculation remains the primary catalyst for short-term price action

- Heightened volatility may remain ahead of this week's major event risk

Bitcoin (BTC) prices have recovered from a three month slide as a combination of speculation and rising institutional interest overshadowed regulatory concerns, enabling Bitcoin bulls the opportunity to regain temporary control over the imminent move. After an aggressive rebound from $30,000, prices have continued to rise, allowing Bitcoin to hold onto double-digits gains in an effort to drive prices back above $40k.

With US earnings well underway, comments by Twitter CEO Jack Dorsey, Tesla CEO Elon Musk and a citing by an Amazon ‘insider’ were the main drivers of the bullish move as speculation and crowd psychology fueled the rally.

The surge in prices after weeks of relatively muted price action continues to serve as a reminder of the volatile nature of Bitcoin and its digital counterparts.

As the momentum of the upward move continued to gain traction, short-sellers were forced to cover existing positions by buying back to close, an additional catalyst for the bullish move.

Elon Musk Tweets: The Impact of Social Media on Markets

With the Fed rate decision now at the forefront of this week’s major event risk, major cryptocurrencies may continue to experience heightened volatility with regulatory concerns forming a potential hindrance for further progression.

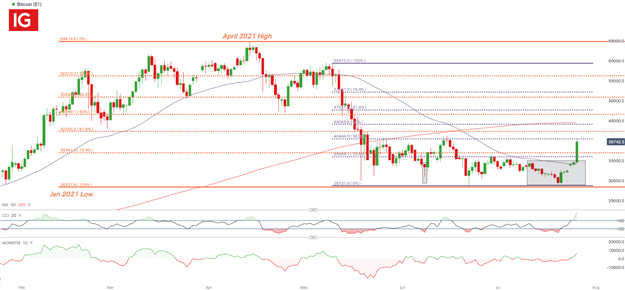

Bitcoin (BTC/USD) Key Levels

As prices continue to move towards the next key level of $40,000, price action has managed to reclaim ground above the 50-Day Moving Average while both the Commodity Channel Index (CCI) and the Momentum Indicator remain in positive territory, confirming the presence of a strong-upward trend.

Bitcoin (BTC/USD) Daily Chart

Chart prepared by Tammy Da Costa

For now, a break of $40,000 could see Bitcoin prices testing the next level of resistance at $42,293, the 38.2% Fibonacci retracement level of the April – June 2021 move.

In contrast, selling pressure may gain traction if prices fall below $37,000 with bearish an increase in bearish momentum bringing $33,000 back into play.

--- Written by Tammy Da Costa, Analyst for DailyFX.com

Contact and follow Tammy on Twitter: @Tams707