Key Talking Points:

- Bitcoin drops below $30,000 as wider risk-off sentiment takes over

- 50% devaluation leaves investors wary about upside potential

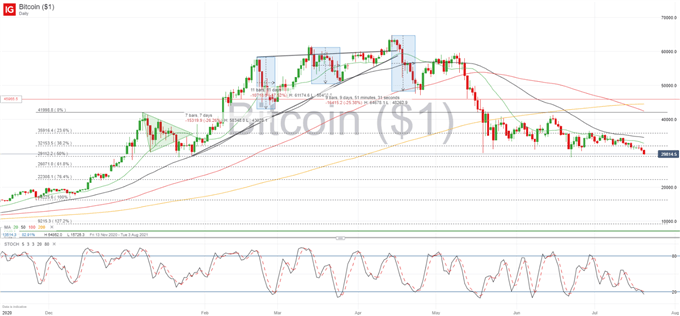

Bitcoin has slumped below $30,000 following a global risk-off move on Monday as Covid-19 concerns are back on the table. BTC/USD had been stuck in a tight range for the month but had taken a slight negative bias over the last few days, leaving it just shy of the 5-month low of $28,843 it printed exactly four weeks ago. This level rests upon the 50% Fibonacci level from the $16,225 to 42,000 surge seen at the end of 2020, which is likely to offer some continued support in the short term.

BTC/USD Daily chart

It seems as though BTC/USD has been unable to pick up any positive momentum and the break below $30,000 could suggest a further pullback towards $20,000 given how the crypto seems to have been moving in $10,000 tranches. That said, I don’t think there is a lot of rush in the pullback like we have seen on previous occasions, so it may be the case of small fluctuations that will ultimately bring the pair lower. If so, the 61.8% Fibonacci at $26,070 could be a good area to look out for support if the 50% level is taken out.

The rush to the safety of the US Dollar if risk-aversion continues could be a significant risk for BTC/USD which will be closely correlated to the weakness in other financial assets. The recent declines in the price of cryptocurrencies are also likely to be limiting further upside above $37,000 as the value of a coin fell over 50% in one month between April and May, making investors wary about the safety of their investment.

How to Read a Candlestick Chart

Learn more about the stock market basics here or download our free trading guides.

--- Written by Daniela Sabin Hathorn, Market Analyst

Follow Daniela on Twitter @HathornSabin