Sterling and FTSE 100 Prices, Charts and Analysis:

- BoE, FOMC and BoJ rate decisions this week.

- House of Commons to vote on the Internal Market Bill.

- FTSE 100 client sentiment mixed to bullish.

This week there are a raft of central bank decision – BoE, FOMC and BoJ – and important data releases that traders must be aware of. In addition, the PM’s Internal Market Bill will be up for discussion and voting in the House of Commons this week with PM Johnson’s 80 seat majority under threat. For all economic data and events, see the DailyFX Calendar.

British Pound (GBP) Latest: Brexit, BoE and Heavyweight Data All Collide This Week

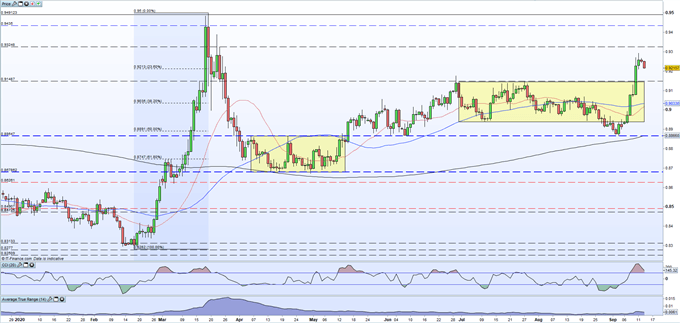

GBP/USD is discussed in the article above and will choppy pre- and post-central bank rate decisions. Looking at EUR/GBP this will likely reflect ongoing Brexit talks and how the government’s Internal Market Bill is seen by members of the House of Commons and the European Union. The pair broke sharply higher over the past 8-10 days, fueled by a strong Euro and a weak Sterling. The upside remains limited in the short-term between 0.9300 and 0.9325, while prior resistance around 0.9145 now turns to support. The pair are moving out of oversold territory and may see a period of consolidation unless politics turn sour again.

EUR/GBP Daily Price Chart (January – September 14, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -4% | -2% | -4% |

| Weekly | -9% | 5% | -6% |

IG client sentiment data shows 25.27% of traders are net-long with the ratio of traders short to long at 2.96 to 1. The number of traders net-long is 1.46% higher than yesterday and 38.08% lower from last week, while the number of traders net-short is 6.34% higher than yesterday and 116.89% higher from last week.We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/GBP prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger

EUR/GBP-bullish contrarian trading bias

Client Sentiment Suggests FTSE 100 May Climb Further

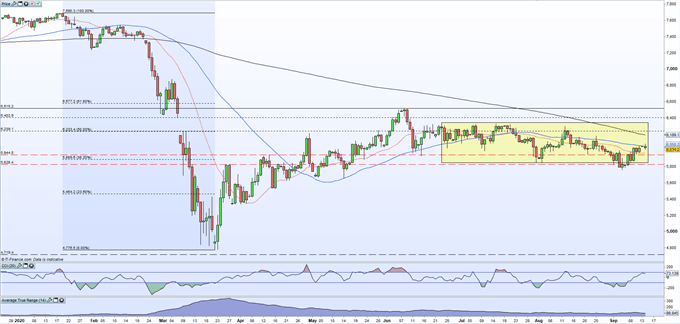

The FTSE 100 is back in its recent trading range, after a brief break lower, aided by the weakness of Sterling. The index is now back above the 20-day moving average and is running into resistance from the 50-dma, currently at 6,050. Recent higher lows add support to the move higher, and any sell-off, while prior support at 5,850 should hold. Above the 50-dma, the next level of resistance is the 200-dma at 6,189 followed by the 50% Fibonacci retracement level at 6,233.

The IG client sentiment gives us a mixed outlook, with positioning – clients are long by 1.83 to 1 – suggesting lower prices, while daily and weekly changes suggest prices may move higher.

| Change in | Longs | Shorts | OI |

| Daily | -30% | 25% | 2% |

| Weekly | -44% | 44% | 0% |

FTSE 100 Daily Price Chart (January – September 14, 2020)

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.