British Pound (GBP) News, Charts and Analysis:

- House of Commons to debate the Internal Markets Bill today.

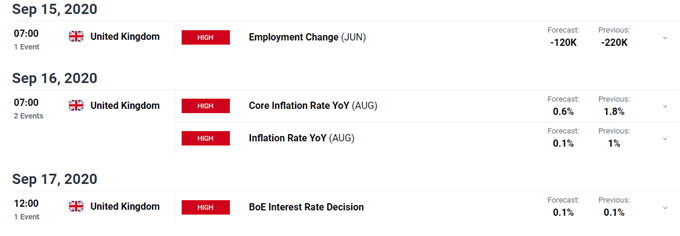

- Employment and inflation data ahead of the latest BoE meeting.

The British Pound opens the session marginally higher across a range of currencies but traders should be aware of a slew of high importance risk events ahead this week that could inject a sudden shot of volatility into Sterling. The most important event this week will take place in the House of Commons, starting today, where MPs will debate the PM’s proposed changes to the Withdrawal Agreement, amendments that have riled the EU and caused heated debate already within the Conservative Party.

Speaking to the BBC over the weekend, Justice Secretary Robert Buckland said that while the PM’s plans were seen as an insurance policy that he hoped would not be needed, he would resign if the UK broke international law in a way that he found unacceptable. PM Johnson has the numbers to get his amendments passed through the Commons, although it may be tight, but he may struggle to get his proposed bill passed through the House of Lords.

The UK data calendar shows that the latest employment/unemployment figures and inflation data will be released this week, ahead of the Bank of England MPC meeting on Thursday. While the employment data on Tuesday is for June, when the UK was still under a majority of lockdown rules, the inflation data is for August and is expected to show price pressures easing further. The Bank of England is likely to address this at their meeting the next day.

For all economic data and events, see the DailyFX Calendar.

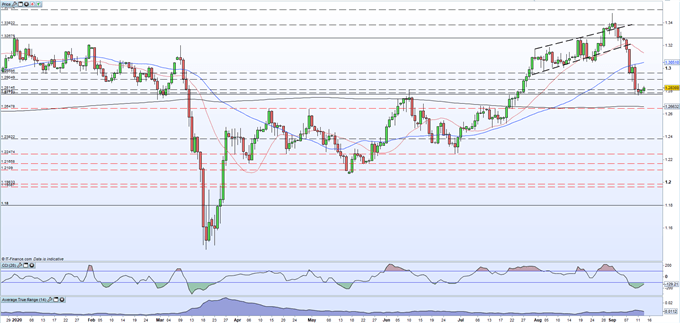

The daily GBP/USD chart shows the pair marginally above last Friday’s low at 1.2762 but still under downside pressure. Bullish price action from the end of June was comprehensively broken last week and there is little in the way of support before the 200-dma at 1.2662. A pair of highs from last week and the 50-dma converge around 1.3036 and should provide short-term resistance. A wide range between support and resistance but with volatility picking-up over the last few weeks (using the ATR) and with the previously mentioned events and data releases, Sterling may well see periods of volatile price action this week.

FTSE 100 Daily Price Chart (January – September 14, 2020)

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

IG client sentimentdata shows 52.60% of traders are net-long with the ratio of traders long to short at 1.11 to 1.The number of traders net-long is 1.44% higher than yesterday and 53.62% higher from last week, while the number of traders net-short is 2.30% higher than yesterday and 23.23% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall. However, positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

Traders of all levels and abilities will find something to help them make more informed decisions in the new and improved DailyFX Trading Education Centre

What is your view on Sterling – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.