USD/CAD Analysis:

- Crude oil volatility may continue in the aftermath of intense weather conditions in the US Gulf Coast (supply constraints)

- USD/CAD exhibiting short term consolidation ahead of BoC Deputy Governor Wilkins speech later today

- IG Client Sentiment showing 2 traders long for every short trader, setting the scene for potentially lower prices for USD/CAD

Crude Oil developments and Deputy Governor Wilkins speech may offer guidance for USD/CAD

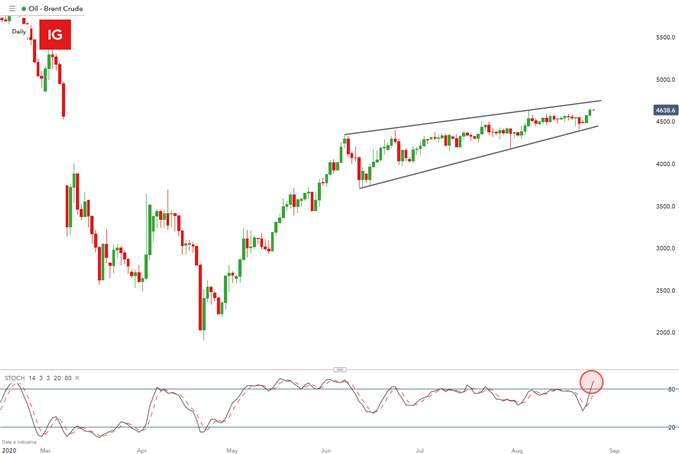

The USD/CAD pairing has been trending lower since the March high and may continue this trend as crude oil climbs higher, however, price advances may be limited as the market enters oversold territory on the stochastic oscillator. The recent uptick in crude oil arose as supply concerns developed around the US Gulf Coast in the wake of Hurricane Laura.

Learn how USD/CAD tends to be correlated with the oil market in this article

Crude Oil Daily Chart

Chart prepared by Richard Snow, IG

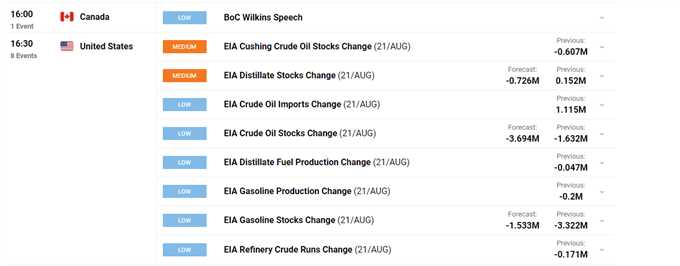

Later today the EIA Cushing crude oil stocks change and EIA distillate stocks change should shed insight into demand and supply dynamics as the global economy attempts to re-ignite economic activity. Oil is often viewed as a benchmark for economic expansion due to its use in manufacturing and distribution – which increase during economic recovers.

Taking a back seat on the economic calendar is the anticipated appearance of the Bank of Canada (BoC) Deputy Governor, Carolyn Wilkins at the Bank’s workshop titled, “Towards the 2021 Renewal of the Bank of Canada’s Monetary Policy Framework”.

For all market-moving data releases and events see the DailyFX Economic Calendar

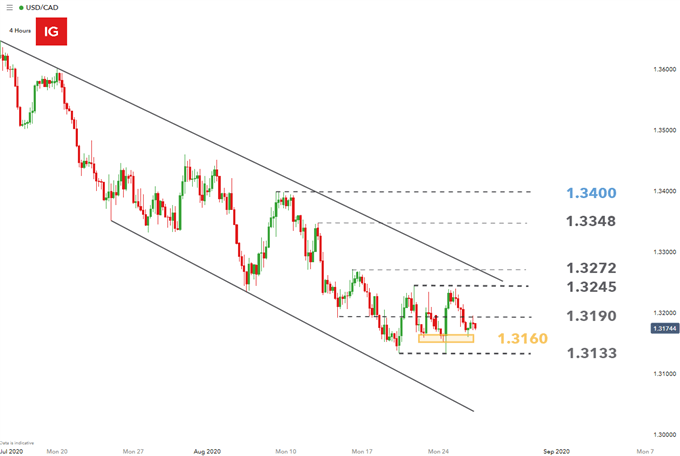

USD/CAD Technical Levels

For the better part of a week, the pair has been trading within a range between support and resistance at 1.3133 and 1.3245, respectively. Of particular interest is the 1.3190 level which cuts right through the exiting trading range and may help guide near term direction.

A break above 1.3190 followed by further bullish momentum would see the upper end of the range come into play at 1.3245. Looking more longer term, if this current period of consolidation proves to be the start of a reversal, price would need to move above 1.3272 and 1.3348 before approaching the 1.3400 level. The 1.3400 mark remains a key level to assign a reasonable degree of confidence to a prolonged bullish move.

From a bearish perspective, upon a failed test of the 1.3190 level, price may approach the next zone of resistance observed around the 1.3160 level with the lower end of the trading range not too far away, at 1.3133. A break below this level may indicate prolonged dollar weakness and a continuation of the larger downtrend.

USD/CAD 4 hour chart

Chart prepared by Richard Snow, IG

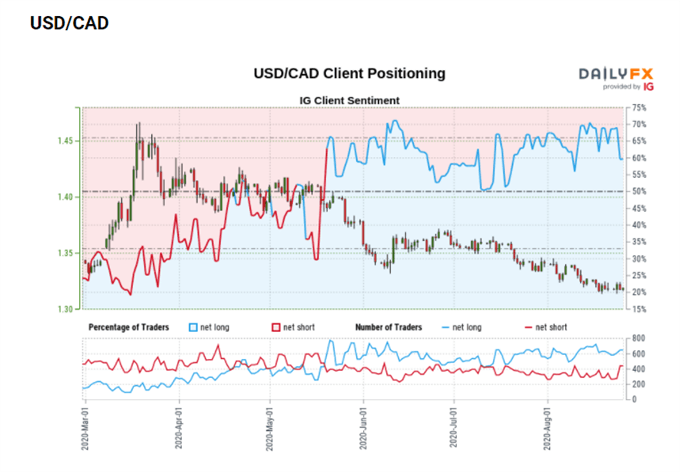

USD/CAD Sentiment Data Hints at Trend Continuation

IG Client Sentiment, IG

- At the time of writing, retail trader data shows 66.76% of traders are net-long with the ratio of traders long to short at 2.01 to 1.

- Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes hints at a USD/CAD-bearish contrarian trading bias.

| Change in | Longs | Shorts | OI |

| Daily | -2% | 7% | 5% |

| Weekly | -30% | 38% | 13% |

--- Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX