USD/JPY, NZD/JPY, CHF/JPY Price Analysis & News

- USD/JPY Pulls Back as US Yields Reverse

- NZD/JPY Edges Lower as Local Banks Forecast Negative Rates in NZ

- CHF/JPY Reversal in the Works?

USD/JPY Pulls Back as US Yields Reverse

The entirety of last weeks ramp higher in USD/JPY has been pared with the pair maintaining its close relationship with US yields. While the weaker USD is also helping the pair, the bigger driver has been treasury yields. As such, with room for 10yr yields to drop in further as it continues to give back much of last week’s surge, eyes are for a retest near-term support at 105.30, in which a break below puts the 105.00 handle into focus.

USD/JPY and US 10yr Yields Maintain Close Relationship

Source: Refinitiv.

NZD/JPY Edges Lower as Local Banks Forecast Negative Rates in NZ

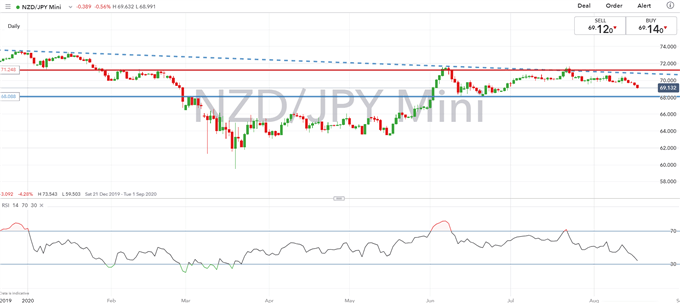

Elsewhere, the New Zealand Dollar remains on the backfoot following last week’s dovish announcement from the RBNZ. In turn, with the central bank intent on lowering bond yields, local banks have altered calls for the RBNZ to go negative with ANZ bank the latest to forecast a negative OCR by April 2021. Consequently, NZD/JPY has taken a fresh leg lower to 69.00 and thus maintains the seasonal pattern of weakening in August.

NZD/JPY Daily Time Frame

Source: IG

CHF/JPY Reversal in the Works?

While typically a more obscure cross, CHF/JPY has garnered attention in recent sessions following a rejection from key resistance. For Japanese Yen bulls, this perhaps offers more room for JPY upside to run, particularly as the SNB remain active in curbing CHF appreciation. However, as we question whether a reversal is in the works, we would need to see a close below 115.90 to strengthen this view.

CHF/JPY Daily Time Frame

Source: IG