Australian Dollar, New Zealand Dollar, AUD/NZD Outlook – TALKING POINTS

- Australian Dollar decline vs New Zealand Dollar could be resuming

- RBNZ rate decision, outlook comparatively more hawkish than RBA

- AUD/NZD rejected at key resistance, trend-defining support in play

AUD/NZD OUTLOOK

After suffering a five percent decline after topping in early-November, AUD/NZD stabilized around 1.0324 and recently retested resistance at 1.0484. However, after the pair closed just on the edge of it, AUD/NZD promptly plunged after the RBNZ rate decision and may now be heading towards a floor it just got up from. However, scope for further losses is not capped at that multi-tiered support zone between 1.0324-1.0308.

A downside breakout there could open the door to retesting the August 2019 swing-low at 1.0283 (gold-dotted line). This makes the prospect of a recovery that much more formidable since the layers of resistance become that much more difficult to surmount as AUD/NZD delves deeper into the abyss. A wider timeframe also underscores the significance of what further downside losses could mean for AUD/NZD’s trajectory.

AUD/NZD – Daily Chart

AUD/NZD chart created using TradingView

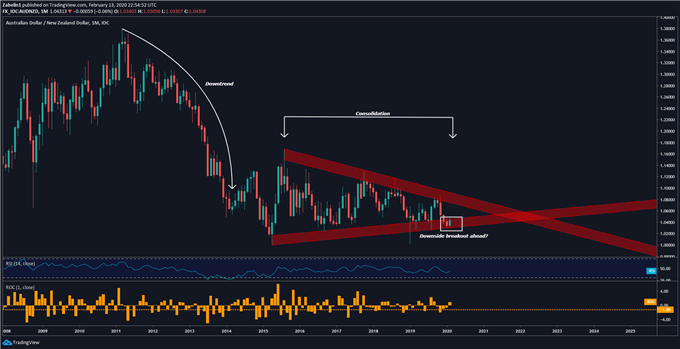

Looking at a monthly chart shows the pair is forming a continuation pattern known as a Symmetrical Triangle. Given the preceding downtrend, the model suggests AUD/NZD may be in store for an aggressive selloff if the pair break the lower range (red channel) with follow-through. Looking ahead, a key data release out of Australia may be instrumental in pressuring AUD/NZD closer to testing key support.

AUD/NZD – Monthly Chart

AUD/NZD chart created using TradingView

AUSTRALIA JOBS DATA

Next week, Australian jobs data – which has tended to induce volatility in AUD crosses – will be published with expectations of a 10.0k employment change. This is markedly lower than the prior 28.9k print with analysts estimating the unemployment rate rising from 5.1 to 5.2 percent for January.

Softer-than-expected prints could inflate rate cut bets and further pressure AUD/NZD as the trajectory for monetary policy between the RBA and RBNZ diverge.

AUSTRALIAN DOLLAR TRADING RESOURCES

- Tune into Dimitri Zabelin’s webinar outlining geopolitical risks affecting markets in the week ahead !

- New to trading? See our free trading guides here !

- Get more trading resources by DailyFX !

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter