New Zealand Dollar, Reserve Bank of New Zealand Interest Rate Decision, Talking Points:

- The Official Cash Rate stayed on hold at 1%

- The RBNZ also cut its first-quarter GDP call

- The New Zealand Dollar gained despite the expected outcome

The New Zealand Dollar rose Wednesday after the Reserve Bank of New Zealand left interest rates on hold at record lows as the market had expected.

The key Official Cash Rate remains at 1%, where it’s been since August 2019.

The central bank had declared itself data dependent and it’s at least possible that, without the coronavirus story dominating the headlines, it might have shifted to a more hawkish policy stance this month, given that the economic numbers out of New Zealand since last it met have been quite strong by and large.

Even so, the central bank’s own forecast for the OCR now suggest that, at present, it may not cut rates at all this year. It called low interest rates necessary to keep inflation and employment around target,but cut its first-quarter Gross Domestic Product growth forecast to 0.4% from 0.7%. The RBNZ fears that the worst impact from coronavirus will be felt in the year’s first half, but hopes that household spending might pick up.

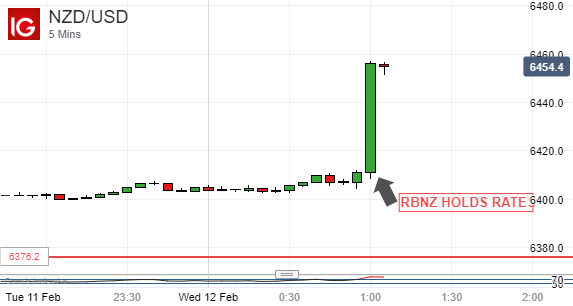

NZD/USD spiked up on the decision. The RBNZ has been known to spring the odd surprise on markets, most recently with the half-percentage-point hack which took rates down to their present lows, so some investors will have awaited the decision before stepping back in.

| Change in | Longs | Shorts | OI |

| Daily | -8% | -17% | -11% |

| Weekly | -18% | -9% | -15% |

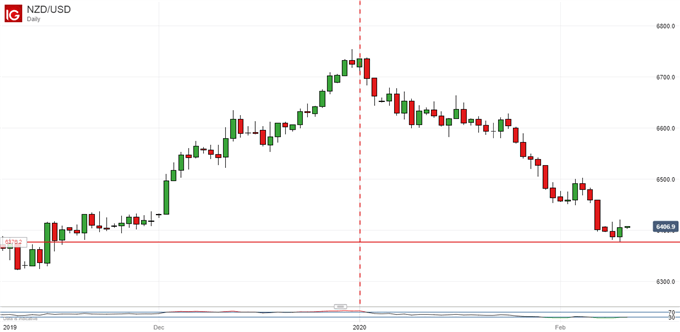

The New Zealand Dollar has been a key casualty of the risk aversion that has accompanied the spread of coronavirus out of China this year. With China an important export partner of New Zealand this is hardly surprising. The currency also tends to do better when markets are surer about prospects for global growth and the virus story is casting long shadows over what was an already clouded economic landscape.

NZD/USD is back down to lows not seen since mid-November 2019, with all of the gains made since, as markets looked with hope to positives like the interim trade deal between China and the US, erased.

As with all other risk-correlated assets it is very difficult to see the New Zealand Dollar rising sustainably again until the coronavirus has been contained and assessments as to its economic impact can be made.

The market will now look to comments from RBNZ Governor Adrian Orr who is due to speak later Wednesday, and also to his country’s parliament this week.

New Zealand Dollar, Resources for Traders

Whether you’re new to trading or an old hand DailyFX has plenty of resources to help you. There’s our trading sentiment indicator which shows you live how IG clients are positioned right now. We also hold educational and analytical webinars and offer trading guides, with one specifically aimed at those new to foreign exchange markets. There’s also a Bitcoin guide. Be sure to make the most of them all. They were written by our seasoned trading experts and they’re all free.

--- Written by David Cottle, DailyFX Research

Follow David on Twitter @DavidCottleFX or use the Comments section below to get in touch!