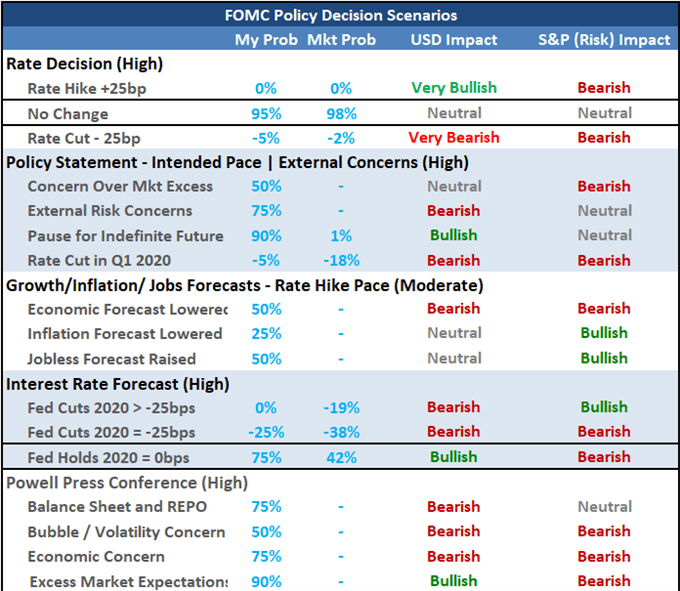

Election and Trade War Talking Points:

- The Fed held rates steady after three consecutive cuts with the outlook leveling out, yet Dollar still dropped through long-term support

- Top event risk ahead is the UK election, but don't underestimate the ECB rate decision's influence over systemic policy influence

- Trade war anticipation remains a critical point of uncertainty: can S&P 500 break congestion or AUDUSD feed its rally with the uncertainty?

What do the DailyFX Analysts expect from the Dollar, Euro, Equities, Oil and more through the 4Q 2019? Download forecasts for these assets and more with technical and fundamental insight from the DailyFX Trading Guides page.

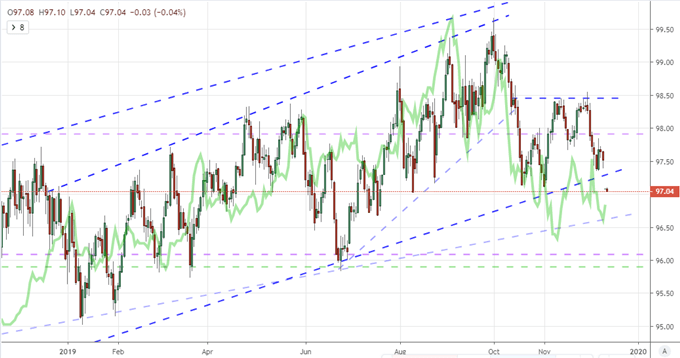

Dollar Breaks Support Despite a Fed Hold - Why?

The Federal Reserve managed to return to the fine line where it managed to surprise absolutely no one with its policy updates and forecasts. Despite that, the Dollar still took a remarkable dive through the trading day. That isn't exactly difficult to do when you hold the benchmark rate unchanged and forecasts for rates over the coming years aren't altered either. Yet, even when the central bank was in the midst of a series of rate cuts - three consecutive 25 basis point reductions - the market wouldn't follow the textbook line of more accommodation translating readily into a slip for the currency and rally for the capital markets. And, that was despite the assurances by the Fed at each of the previous meetings that it didn't anticipate on cutting. If we were digging into the details, perhaps we could saddle the blame for the eventual bearish Dollar move on Chairman Powell's remarks during the subsequent press conference that a rate cut wouldn't happen until it was clear that inflation was high and persistent.

Chart of DXY Dollar Index and Differential in Dec 2019-2020 Fed Fund Futures (Daily)

A high barrier for a rate hike following the quick dovish reversal in policy course over the past 15 months and a series of three rate cuts isn't at all a surprise. Further, looking into the forecasts for rates in the Summary of Economic Projections (SEP), the central bank still expects to hike in 2021 and 2022 - just a single 25 basis point move each year. If the Greenback lost ground because the hope of a hike has diminished, this relatively high relative plateau relative to so many other exceptionally dovish counterparts should pose a significant counterbalance as FX is founded on comparative valuations (Dollar priced in Euro, Pound, Yen, etc). If on the other hand, skepticism around the Fed's holding pattern is the perpetrator of this move, then the insinuation of economic and/or financial strain that would warrant such a shift would likely trigger risk aversion which could revive demand for a safe haven. Through it all, the questions of a Dollar breakdown - like the one the DXY signaled tentatively - come under heavy question. If anything, even the general market conditions of deflated liquidity and seasonal expectation pose a serious hurdle. Can the Dollar catalyze a difficult breakdown with this backdrop?

Chart Created with TradingView Platform

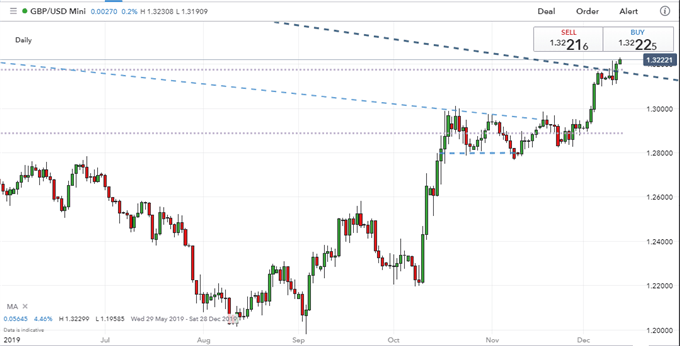

Top Event Risk Ahead: ECB Rate Decision and UK General Election

As we move on from the Fed decision, monetary policy as a speculative driver remains a broader concern. For scheduled event risk, the European Central Bank (ECB) is due to update its own policy mix. The group is unlikely to alter its active and extreme mix of accommodative policy with a negative discount rate and ongoing stimulus effort. Nonetheless, this is not a time to discount surprise...nor desperation. As the first official meeting of new President Christine Lagarde, the event is important as a course setting for the increasingly-bifurcated group. Ignoring the loud element of skeptics to extreme easing, would be overlooking a building risk while acknowledging their skepticism would draw explicit attention to the diminished effectiveness of monetary policy. Should confidence in central bank buoyancy collapse, there is a broad gap in risk that will pull markets lower.

For a more likely volatility event, the UK general election has already proved itself to have the attention of Pound traders. The Sterling has offered up short-term but dramatic volatility these page 48 hours. An update Tuesday from YouGov suggested the Conservative Party's Parliamentary seat lead dropped by 30 sets, an update that sent a short-term bearish jolt through the currency. This past session, the Labour party climb to challenge was thrown into doubt with a 30% standing that offered an 11 percentage point drop from the relative figure. This will a potentially tumultuous fundamental reading with polls open late into the evening and restrictions on extrapolating outcomes. It is best to wait for a definitive assessment before committing to any Sterling conviction. That said, the election's international (FX) implications are firmly anchored to Brexit next steps. A scenario that aligns more to a hung parliament will generate volatility without the benefit of clear singular conviction.

| Change in | Longs | Shorts | OI |

| Daily | 3% | -7% | -3% |

| Weekly | 4% | -10% | -5% |

Chart of GBPUSD (Daily)

Chart Created with IG Charts

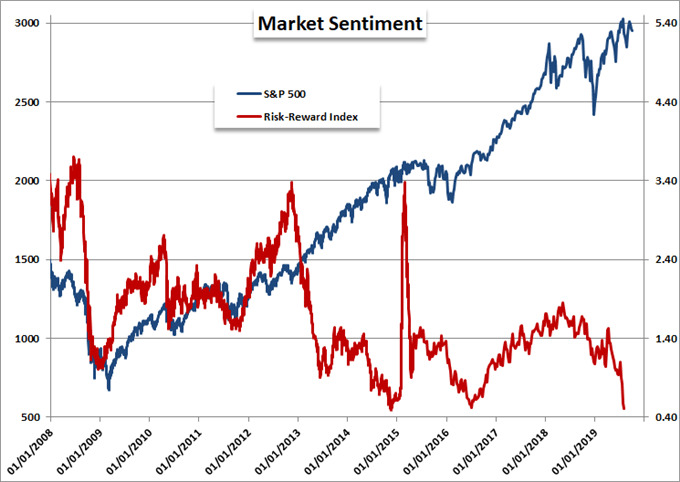

Trade Wars Still Hold the Greatest Sway Over Risk Trends and Momentum

As we pass through the top event risk of the week, it is important to keep tabs on weighty anticipation and systemic implications for the US-China trade war milestone this weekend. On December 15th, the US has warned it will increase the tariff list on Chinese imports if the two countries don't come to some understanding on their negotiations. There is plenty of rumor that an extension is being planned by the Trump Administration to avert disaster, but there is a lot at risk in global sentiment should that defense move not occur and relatively limited benefit should they reach an accord. Disproportionate risk-reward scenarios for critical events should always be closely monitored. With a global influence, this is a particularly important deadline.

Thinking strategically from the perspective of US and Chinese officials, raising the stakes in the already troubled negotiations between the two largest individual economies in the world would likely be counterproductive. That said, given their respective size, they can afford to push their standoff even further - to the detriment of their many, external trade counterparts. It would be presumptuous to believe that the White House would default to capitulation in order to keep the peace when it has steadily raised the pressure since the trade war began. Consider that for AUDUSD. The pair made a break through a year-and-a-half long trendline resistance this past session between the Aussie Dollar lift and Dollar retreat. Is it practical to expect a bullish follow through before the trade war deadline? Is a long-term trend reversal reasonable to expect in fading December liquidity?

Chart of AUDUSD with 200-Day Moving Average (Daily)

Chart Created with IG Charts

If you want to download my Manic-Crisis calendar, you can find the updated file here.

.