Gold Price Forecast, Analysis and Charts:

- Pennant breakout to the upside suggests higher prices in the short-term.

- US GDP. FOMC and non-farm payrolls all out this week.

Brand New Q4 2019 Gold Forecast and Top Trading Opportunities

DailyFX Interactive Global Commodities Infographic

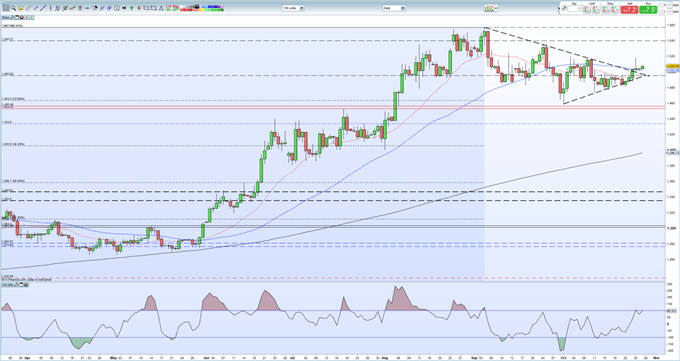

Gold has broken higher and has taken out resistance from the bullish pennant formation that has restricted price movement in the last two weeks. The daily chart below shows how gold pressed the supportive uptrend line on multiple occasion before breaking higher as the apex of the bullish pennant formed. The precious metal has opened above the old resistance trendline which should now turn supportive. The first level of resistance is seen between $1,518/oz. and $1,520/oz. before the late-September double top around $1,535/oz. comes into play. Support seen from $1,500/oz. down to the trendline around $1,495/oz.

Gold Price Testing Support as Merging Trendlines Hint at a Breakout

The economic data and events calendar this week is packed full of high importance US releases. While the gold/US dollar correlation holds, these releases, including US Q3 GDP, FOMC and non-farm payroll data, all have the ability to change the outlook for gold. The precious metal may also come under pressure from any updates about the ongoing US-China trade war, with progress said to be being made at the moment.

Gold Price Chart (March – October 28, 2019)

How to Trade Gold: Top Gold Trading Strategies and Tips

IG Client Sentiment shows that how traders are positioned in a wide range of assets and markets.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.