CRUDE OIL PRICE OUTLOOK IMPROVES ON OPEC PRODUCTION CUT PROSPECTS

- Crude oil prices just spiked on reports that OPEC and its allies are considering deeper production cuts which could be announced at the oil cartel’s December meeting

- The price of crude oil has remained largely rangebound this year as the commodity fluctuates in response to oil supply shocks and weak demand due to slowing global GDP growth

- Check out these Top Crude Oil Trading Strategies & Tips every trader should know

- Download the DailyFX 4Q-2019 Crude Oil Forecast for comprehensive fundamental and technical crude oil price outlook

Crude oil prices skyrocketed over 2% on news that OPEC – the organization of petroleum exporting counties – and its allies are debating whether to extend and potentially increase crude oil supply cuts. OPEC+ has already curbed crude oil production owing largely to protracted slowing global GDP growth that stems largely from the ongoing US-China trade war uncertainty. Rising recession risk amid sharply deteriorating economic data and weaker global GDP growth outlook has dampened demand for crude oil, which has served as a major headwind for crude oil prices.

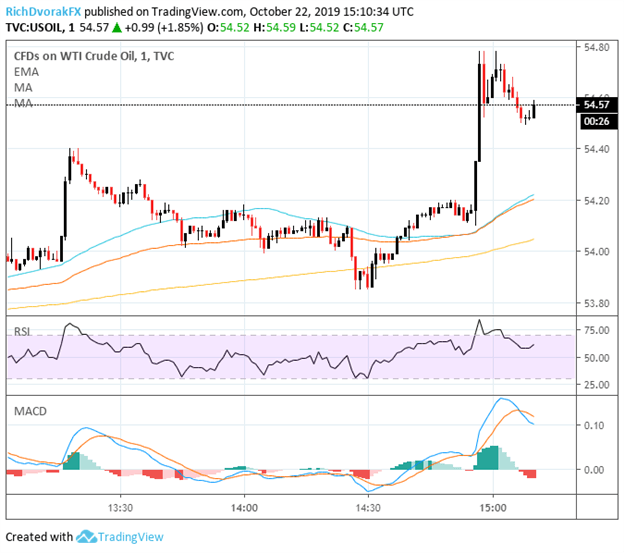

CRUDE OIL PRICE CHART: 1-MINUTE TIME FRAME (OCTOBER 22, 2019 INTRADAY)

Chart created by @RichDvorakFX with TradingView

I recently noted that the market’s recent influx of risk appetite largely in response to growing US-China trade deal hopes stood to provide a strong degree of buoyancy for crude oil prices back when the commodity was trading near the 52.00 handle. The prospect that the December OPEC meeting could reveal the extension of crude oil supply cuts adds another positive tailwind for crude oil price bulls – particularly if OPEC production cuts exceed expectations as they did last year.

-- Written by Rich Dvorak, Junior Analyst for DailyFX.com

Connect with @RichDvorakFX on Twitter for real-time market insight