S&P 500 Price Outlook:

- The S&P 500 dipped lower early in Thursday trading but eventually pared losses to end nearly unchanged from Wednesday’s close

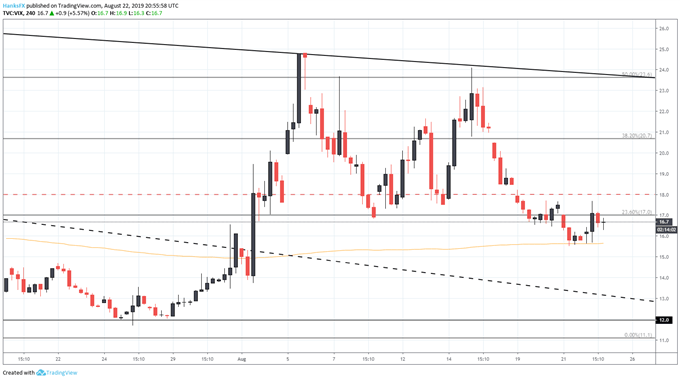

- Still, the VIX remained elevated heading into Friday trading

- Interested in equities? Check out the DailyFX Podcast with Andrew Milligan, head of global strategy at Aberdeen Standard Investments

S&P 500 Price Outlook: Traders on Edge as VIX Pops

The S&P 500, Dow Jones and Nasdaq 100 were faced with widespread uncertainty on Thursday as traders jostled for position ahead of incoming Fed speak that possesses great market-moving potential. Although the three indices pared major losses and the Dow Jones was dragged higher by Boeing (BA), the VIX Index remained elevated into the close which speaks to the fear amongst investors – which is understandable given the stakes.

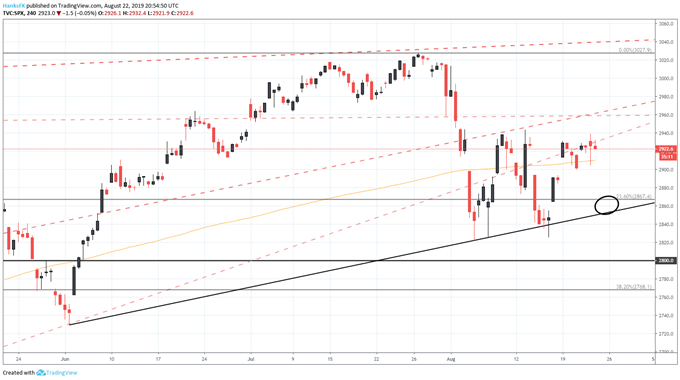

S&P 500 Price Chart: 4 - Hour Time Frame (June – August) (Chart 1)

Chart created with TradingView

As it stands, markets are expecting a 25-basis point cut at the September FOMC meeting – while others have called for a 50-basis point cut at minimum. Some analysts, myself included, argue the prospect of further easing has already been priced in which has allowed the S&P 500 to maintain its robust valuation despite an expanded trade war and inverted yield curve.

Sign up for our Free Weekly Equity Webinar in which critical technical levels and fundamental themes are analyzed each week.

Therefore, if the assumption is correct, anything less than complete capitulation from Fed Chairman Jerome Powell and his peers could seriously disappoint stock traders and result in price declines which could potentially see the Index retest the trendline from June.

VIX Price Chart: 4 – Hour Time Frame (June – August) (Chart 2)

Chart created with TradingView

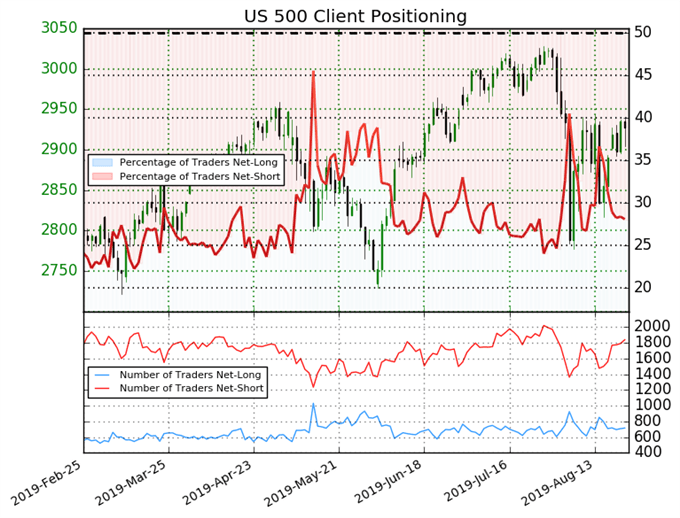

On the other hand, IG Client Sentiment Data suggests the S&P 500 may be destined for greater heights as traders remain net-short. For more technical analysis and fundamental updates on the major equity markets, follow @PeterHanksFX on Twitter.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Canadian Dollar Price Forecast: USD/CAD Strength May Fade