MARKET DEVELOPMENT – Crude Oil Prices Buoyed by Declining Crude Inventories

DailyFX 2019 FX Trading Forecasts

Oil: Crude oil futures are notably firmer this morning with Brent crude up over 1% following yesterday’s API crude oil inventory data. The report showed a larger than expected crude drawdown of 6.02mln barrels over the last week (Exp. 2.6mln barrels). Alongside this, reports of supply disruptions at Libya’s El-Sharara oilfield has also underpinned the complex. Eyes will be on the DoE crude report for confirmation of the API data.

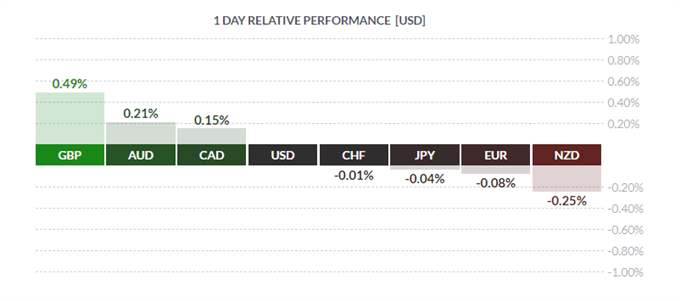

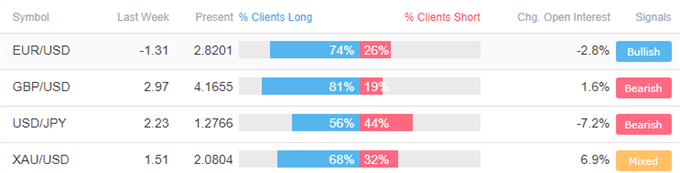

GBP / EUR: After 2-days of heavy selling for GBP, the currency is showing modest gains this morning, reclaiming the 1.22 handle amid a bout of profit taking ahead of the FOMC and BoE rate decisions. Elsewhere, EURUSD trades within a tight range as today’s mixed inflation and growth data unlikely to change the near-term outlook for the ECB with the central bank scheduled to announce a fresh stimulus package at the September meeting.

AUD / CAD: Across commodity currencies both the Aussie and Loonie are firmer vs the US Dollar with the latter benefitting from better than expected GDP figures, while the Q2 inflation report from Australia has largely done enough to keep the RBA from lowering interest rates at next weeks meeting.

Source: DailyFX, Thomson Reuters

How to use IG Client Sentiment to Improve Your Trading

WHAT’S DRIVING MARKETS TODAY

- “FTSE 100 Technical Outlook – Monday Rally Coming Under Fire” by Paul Robinson, Currency Strategist

- “Gold Price, Crude Oil Price: Breakouts Ahead of Fed Rate Decision” by Nick Cawley, Market Analyst

- “US Dollar Outlook: GBPUSD, USDJPY FOMC Set-Ups” byJustin McQueen, Market Analyst

- “Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX