USDPrice Analysis and Talking Points:

See our quarterly USD forecast to learn what will drive prices throughout Q3!

GBPUSD | Outlook Remains Weak, Eyes on 1.2000

The outlook for the Pound remains weak as the currency trades at a fresh 2yr low against the US Dollar. Momentum indicators continue to tilt to the downside with any modest rallies potentially offering opportunities to be faded. The YTD low resides at 1.2118 in which a closing break below could see GBPUSD eyeing a move towards the psychological 1.20 handle. Given the rising threat of a no-deal Brexit, risks continue to remain tilted to the downside.

GBPUSD PRICE CHART: Weekly Time Frame (Nov15 – Jul 19)

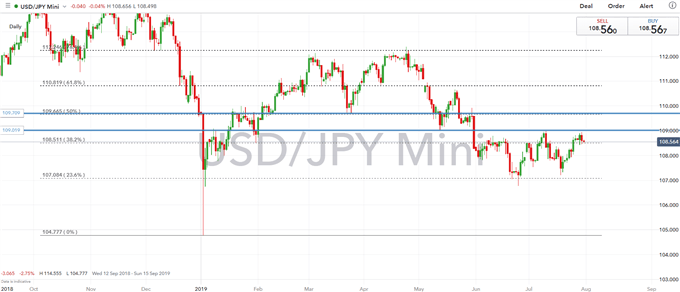

USDJPY | Range Top Holds Firm, Downside Risks Remain

USDJPY has been stuck within the 107-109 range since the beginning of June with the range top once again holding. As 109 continues to hold, this offers an opportunity to fade gains as risks are slightly tilted to USDJPY downside. Keep in mind that the sentiment regarding equity markets will also play a factor in the direction of the fair, while all eyes will lie on the FOMC rate decision.

USDJPY PRICE CHART: Daily Time Frame (Sep 18 – Jul 19)

FX TRADING RESOURCES:

- See our quarterly USD forecast to learn what will drive prices through mid-year!

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX