Talking Points:

- Weaker IFO figures reinforce a slowing German economy suggested by weaker than expected PMIs

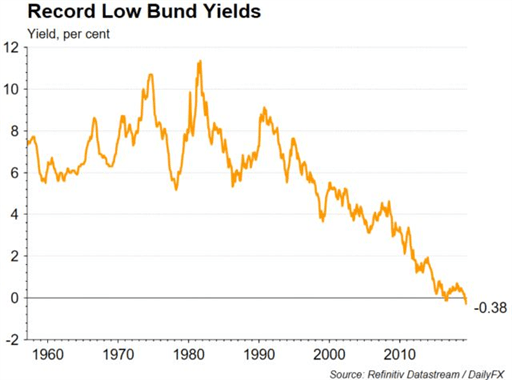

- German bond yields at their lowest level on record as investor expectations worsen

- EURUSD continues to head towards two-year lows of 1.1076 ahead of ECB rate decision meeting

Join our analyst Nick Cawley for live coverage of the ECB rate decision meeting at 1130 GMT

The Eurozone continues to show weakness as business confidence in Germany suffers another blow. The common currency was feeling the heat of the rate decision this morning as it traded lower against most G10 currencies.

EURUSD May Break Through Critical Support After ECB Rate Decision

EURUSD was trading mostly unchanged heading into the European open but the Euro bears managed to regain control and pushed the pair close to the 1.1128 support line in anticipation of German IFO figures to be released, ahead of the ECB rate decision meeting. EURGBP was losing some of the gains it had been steadily making since the beginning of May, but this was partly due to a rebound in sterling (GBP) as traders continue to digest the news about Boris Johnson’s election as PM. The pair was trading at month-lows of 0.8920 at the start of the session.

Business climate in Germany for the month of July was 95.7 well below expectations of 97.0, and down from the previous month’s figure of 97.4. Current sentiment continues to show weakness in the Germany economy falling below 100 to 99.4, whilst future expectations were down to 95.7. These lacklustre figures come on the back of weakening PMI figures released yesterday, where manufacturing PMI continued to fall further below the 50 line, falling two points from 45.0 to 43.1, hitting an 84-month low amidst fears that slowing growth and trade disruption could push the country into a recession. The economic boom seen in the last ten years has come to an end leading into a sideways movement that could result in a downturn.

German Bund yields are trading at their lowest level ever, with the latest round of 10-year bonds offering a yield of minus 0.38%, down from minus 0.24% in June. The lowering yields come amid fears of a global economic slowdown which has been pushing prices of highly rated bonds higher, meaning that investors who purchase these bonds and hold them to maturity are likely to make a loss. Bond prices have been soaring in the last few months on the back of expectations that the ECB would reintroduce monetary stimulus coupled with a host of negative data from Germany, which has kept bond yields heading lower.

All four PMIs across the Eurozone failed to reach expectations, signalling one of the weakest expansions in recent years, and giving up the mild gains seen in the month of June. The case for a rate cut from the ECB is strengthening but it is unlikely that a cut will come in today’s meeting, with expectations that Mario Draghi will announce the terms of a new round of QE, cementing the basis for a 10 bps cut to come in September if economic conditions do not improve.

Recommended Reading

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q3 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst

To contact Daniela, email her at Daniela.Sabin@ig.com

Follow Daniela on Twitter @HathornSabin