EURUSD, GBPUSD Analysis and Talking points

- UK jobs data below expectations but unemployment at its lowest in 44 years

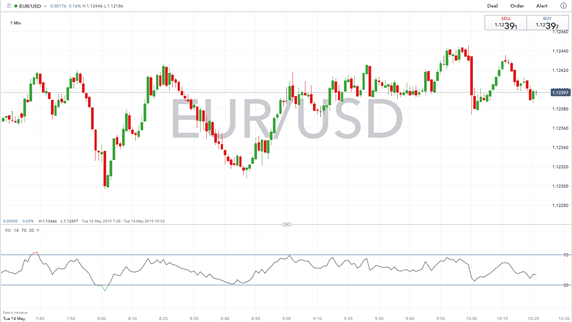

- Mixed economic sentiment provides little direction as EURUSD traders remain focused on trade war developments

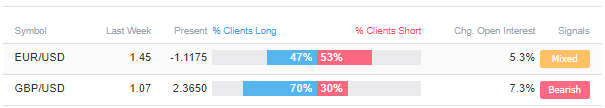

IG Client Sentiment

EURUSD saw some muted downward pressure as the ZEW Economic Sentiment figures revealed a negative outlook on the future growth of Germany and the Eurozone amid the recent escalation in trade wars between the US and China. Consequently, this has halted the recent upside in the pair, which had been supported from the depreciation in the Dollar following the latest trade war developments.

Meanwhile, Sterling continued its macroeconomic data “ignorance” as GBPUSD and EURGBP remained little changed after slightly disappointing UK jobs data was released.

EURUSD PRICE CHART: 1-minute Time-Frame (May 14, 2019)

- UK jobs data

The UK economy added 99k jobs in the 3 months to March, down from the 179k added during the previous period, and below expectations of 141k. Average weekly earnings has dropped to 3.2% from 3.5% in March, again below expectations of 3.4%. The employment rate in March was 76.1%, the joint-highest level on record. Additionally, unemployment rate was 3.8%, its lowest levels since December 1974.

The effect of economic releases on Sterling has been muted in recent weeks as investors focus on Brexit and UK politics developments for any guidance.

- Zew Economic sentiment

Despite current sentiment in Germany being better than expected, the ZEW Economic Sentiment for the month of May was -2.1 for Germany, down from 3.1 the previous month and below expectations of 5. The sentiment was -1.6 for the Euro-zone, a drop from last month’s 4.5, and way below its long-term average of 22.4. This figuremeasures the outlook on the economy in the next 6 months, with a value above 0 indicating a positive outlook on the economy and a value below 0 a negative outlook on the economy.

Recent trade developments were expected to have a negative effect on business sentiment in export-heavy Germany and the figure is not surprising for the Euro-zone as the EU downgraded its growth forecasts in last week’s economic forecast. Slower growth in Germany has now been added to the top risks that the Euro-zone faces behind Brexit and US-China trade wars.

- EURUSD traders’ focus may now shift towards Euro-zone GDP to be released on Wednesday morning with an expectation of stagnant growth.

IG Client Sentiment – Retail trader data shows 50.8% of traders are net-long with the ratio of traders long to short at 1.03 to 1. The number of traders net-long is 2.8% higher than yesterday and 9.6% lower from last week, while the number of traders net-short is 1.8% lower than yesterday and 26.7% higher from last week. We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EURUSD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EURUSD-bearish contrarian trading bias.

Webinar: Trader's Toolbox: How to Identify Trends with Trader Sentiment – Jeremy Wagner

Recommended Reading

GBP Volatility Likely as Leadership Challenge to May Comes Closer – Daniela Sabin Hathorn, Junior Analyst

Eurozone Debt Crisis: How to Trade Future Disasters – Martin Essex, MSTA, Analyst and Editor

KEY TRADING RESOURCES:

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- See our Q1 forecasts to learn what will drive FX the through the quarter.

--- Written by Daniela Sabin Hathorn, Junior Analyst