SEK, NOK TALKING POINTS – NORGES BANK, USD/NOK, FED, GLOBAL GROWTH, CRUDE OIL PRICES, TRUMP TARIFFS

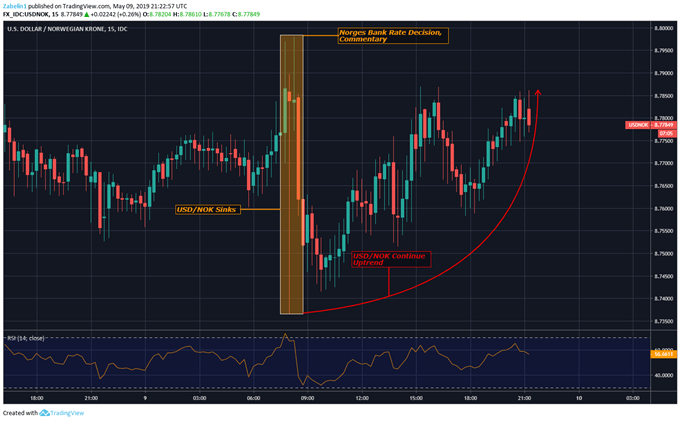

- USD/NOK sinks on Norges Bank before resuming uptrend

- What does Dollar-Krone’s rise say about global growth?

- How will US CPI publication impact Fed monetary policy?

See our free guide to learn how to use economic news in your trading strategy !

NORGES BANK RATE DECISION

The Norwegian Krone initially spiked after the Norges Bank (NB) decided to hold the benchmark rate at 1.00 percent, and additional commentary revealed that an additional rate hike will “most likely” take place in June. While most other major central banks have paused their rate hike cycle, the Norges Bank remains one of the more hawkish monetary authorities in the world, though they too may succumb to the pressure of their peers.

Fears of global deceleration and fragile US-China trade relations may continue to weigh on sentiment and drag down crude oil prices. As an export-driven economy with a heavy reliance on the petroleum sector, the Norwegian economy is vulnerable to volatile shifts in global demand. Slower growth out of Europe – Norway’s biggest trading partner – may also weigh on growth and could derail the NB’s rate hike trajectory.

These lingering fears may explain why USD/NOK continues to climb higher despite the Norges Bank expressing a considerably more hawkish outlook than the Fed. The anti-risk appeal and unparalleled liquidity of the US Dollar is attracting investors as uncertainty about fundamental themes continues to weigh on the global outlook. To learn more about USD/NOK price action, see my USD/NOK technical forecast here.

US CPI, FED MONETARY POLICY

A slew of US CPI data will be published later today with expectations of core inflation showing growth at 2.1 percent. Following the latest FOMC meeting, the upcoming data may carry additional weight after Fed Chairman Jerome Powell said that the temporary lull in inflation was “transitory”. Until price growth – or there lack of – warrants an adjustment in policy, neutral tones from the Fed will likely persist.

CHART OF THE DAY: USD/NOK

NORDIC TRADING RESOURCES

- Join a free Q&A webinar and have your trading questions answered

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitri on Twitter