Bitcoin (BTC) Price, Chart and Analysis:

- New York AG Letitia James gunning for Bitfinex and Tether operators

- Bitcoin slumps, partially recovers but resistance remains in place.

Bitcoin (BTC) Rattled on USD850 million Exchange Loss Claims

The latest Bitcoin rally ended abruptly Thursday on news that New York Attorney General Letitia James had filed allegations of a cover-up between the operators of cryptocurrency exchange Bitfinex and stable-coin Tether (USDT). The filing notes that ‘Bitfinex Struggles to Fill Client Withdrawal Requests Due to Crypto Capital’s Loss or Theft of Approximately $850 million.’

The filing also alleges that Bitfinex comingled client and corporate funds, in excess of USD1 billion, through a Panamanian payment company Crypto Capital as the exchange had no bank to work with.

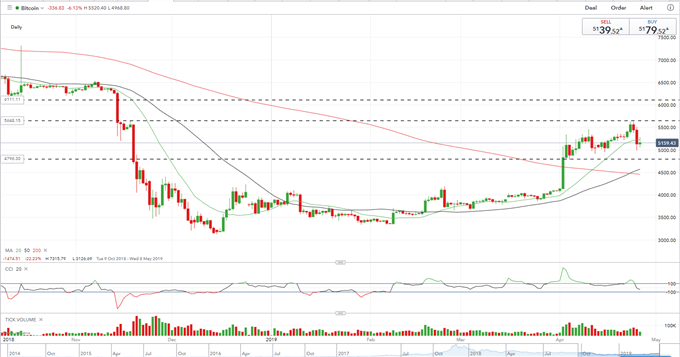

Bitcoin slumpedby 10% as the news hit the wires, spiking below $5,000 before recovering some of its losses. The recent Bitcoin (BTC) rally hit resistance around $5,620, the lower level of an important gap between $5,648 and $6,111, the first upside target. The ‘bullish golden cross’ that occurred on April 23 turned out to be not such a bullish signal as many thought as prices have fallen ever since. There are a cluster of minor support levels between $4,900 and $5,000 before just below $4,800 comes into play.

IG Client Sentiment Data shows how retail are positioned in a variety of cryptocurrencies. See how daily and weekly positioning can affect our trading bias. Bitcoin (BTC) trade data shows 82.4% of traders are net-long, a bearish contrarian trading bias.

A Guide to Day Trading Bitcoin and Other Cryptocurrencies.

Bitcoin (BTC) Daily Price Chart (October 2018 – April 26, 2019)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Bitcoin and Litecoin – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.