BREXIT LATEST – TALKING POINTS

- UK PM Theresa May’s EU-UK Withdrawal Agreement has been defeated again, this time by a margin of 286 votes in favor to 344 against. GBPUSD dropped below 1.3000 for the first time since March 11 following the results

- European Council President Donald Tusk has called for an emergency Brexit summit on April 10; the UK is set for a no deal, ‘hard Brexit’ on April 12

- Take a look at this Brexit Timeline for a chronological series of events surrounding UK leaving the EU and impact on the British Pound

Looking for longer-term forecasts on the British Pound? Check out the DailyFX Trading Guides

UK PM Theresa May’s EU-UK Withdrawal Agreement has been defeated again, this time by a margin of 286 votes in favor to 344 against. The third failed vote now puts the prime minister in the uneasy position of feeling immense pressure to resign.

After reaching an agreement with the European Commission to extend the Brexit deadline to April 12, the failure of the third vote means that a no-deal, ‘hard Brexit’ is possible in two weeks time. This can still occur despite British MPs voting previously against no-deal Brexit as the motion was not legally binding – hard Brexit thus remains the legal default.

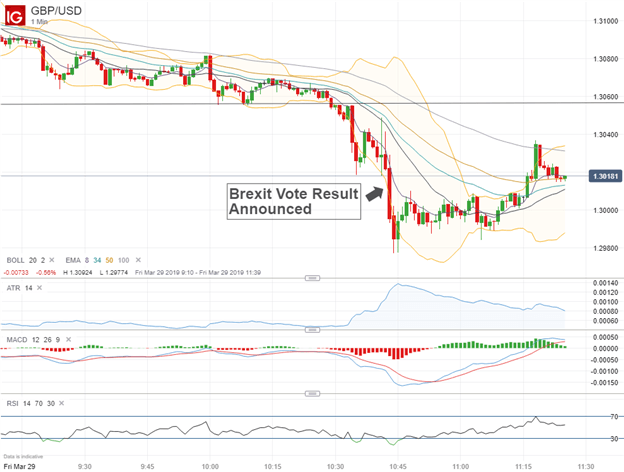

GBPUSD CURRENCY PRICE CHART: 1-MINUTE TIMEFRAME (MARCH 27, 2019 TO MARCH 29, 2019)

GBPUSD plunged from 1.3065 to a low of 1.2984 immediately following the news but has since climbed back above the 1.3000 handle.

In response to today’s third ‘meaningful vote’ results, European Commission President Donald Tusk has called for an emergency summit on April 10 in hopes to avoid the worst-case scenario as the fate of Brexit – as well as GBP and the UK’s economy – hangs in limbo.

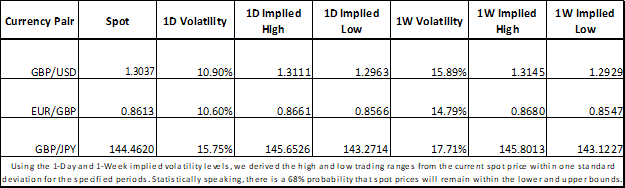

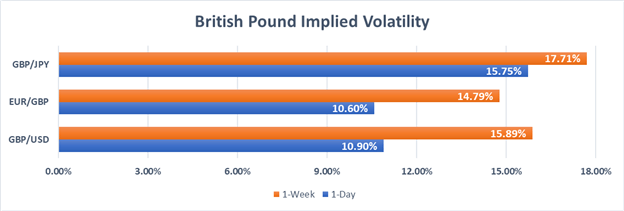

However, Tusk and other EU leaders have adamantly stated that the European Council will not re-open Brexit discussions to further negotiate outstanding issues like the Irish backstop which has caused much of the impasse. As such, the vast uncertainty surrounding Brexit has recently pushed GBP implied volatility to extremes.

BRITISH POUND IMPLIED VOLATILITY AND TRADING RANGES

FOREX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

---

Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX