BREXIT LATEST – TALKING POINTS

- GBPUSD slid lower following a slew of votes from British Parliament to delay Brexit as uncertainty remains over the UK’s departure from the EU

- Although a number of amendments failed to garner enough support, the government’s main motion to revoke Article 50 and extend the March 29 Brexit deadline passed

- Check out these tips on Using News and Events to Trade Forex

British MPs gathered once again in the House of Commons for a third consecutive day of Brexit voting. This time Parliament set out to decide on revoking Article 50 which prompts the government to request permission from the European Union to delay the quickly approaching Brexit deadline only 15 days away.

Today’s votes over extending Article 50 was brought about after Prime Minister Theresa May’s renegotiated Withdrawal Agreement failed to gain enough Parliamentary support on Tuesday while yesterday MPs also rejected the idea of no-deal Brexit.

BREXIT ARTICLE 50 AMENDMENTS AND VOTE RESULTS

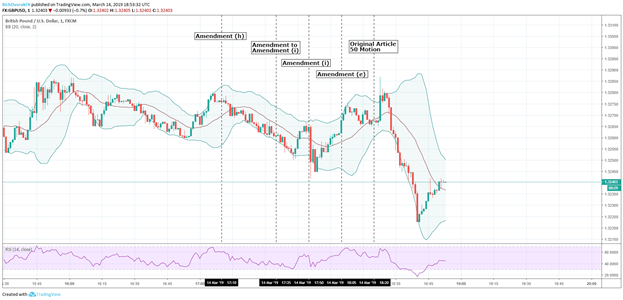

Four separate motions were selected to vote on and all looked to amend Prime Minister Theresa May’s call to push back the official March 29 Brexit date spelled out in Article 50. Amendment H, which called for an extension to hold a second referendum, was called on first but only 84 MPs voted in favor while 334 opposed.

Amendment to Amendment I was up next with the original Amendment I following – both of which failed but by a much tighter margin with 311 ayes and 314 noes on the original amendment. Thirdly, Jeremy Corby’s Amendment E was shot down with 318 voting no and 302 voting in favor while lastly Amendment J – which would have prevented a third meaningful vote over the PM’s Brexit deal – was tabled shortly after. Despite the failure of the amendments, the government’s main motion to revoke Article 50 passed with an overwhelming 412 to 202 majority.

GBPUSD CURRENCY PRICE CHART: 1-MINUTE TIME FRAME (MARCH 14, 2019 INTRADAY)

Markets largely expected MPs to vote in favor of a Brexit delay headed into today’s session. Parliament is now expected to hold another vote next Wednesday as the UK government scrambles to find enough support for its Withdrawal Agreement.

As the Prime Minister stated yesterday, however, the legal default is a hard, no-deal Brexit if a deal cannot be agreed upon before the deadline. Also, despite today’s vote passing the motion to request a Brexit deadline extension, the delay is still contingent on approval from the other 27 members of the European Union.

More Brexit Insight and GBP Trading Resources

- British Pound – What Every Trader Needs to Know

- Sterling Outlook – GBPUSD, EURGBP Price Analysis

---

Written by Rich Dvorak, Junior Analyst for DailyFX

Follow @RichDvorakFX on Twitter