GBPUSD Price, Volatility and Brexit

- Brexit vote shambles – another one tonight.

- Wednesday’s GBP rally points the way.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

Another Brexit vote and another defeat for UK PM Theresa May with some in her cabinet now openly rebelling against their leader, undermining the government’s remaining authority. Last night’s vote makes a long extension to Article 50 highly likely – unless there are further amendments at tonight’s vote – and that is giving the British Pound a strong push higher. Going forward, while Sterling is underpinned by No Deal Brexit being effectively taken off the table, the possibility of more political upheaval is worth factoring into any Sterling trade as financial markets take a very dim view on political uncertainty.

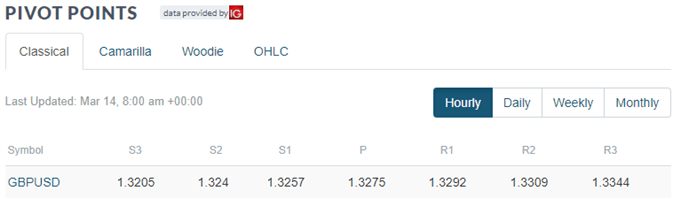

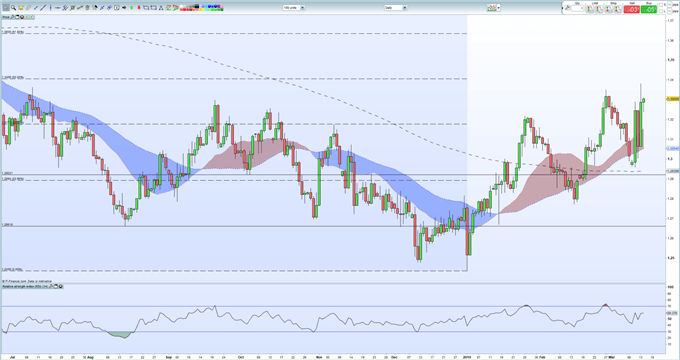

GBPUSD –Technical Analysis

Cable touched a spike high of 1.3384 Wednesday’s post-vote before edging back during the Asian session. The outlook for GBPUSD remains positive with the 1.3300 handle now taken out of the equation, leaving the 50% Fibonacci retracement level at 1.3406 the initial upside target. The series of higher highs and higher lows off the January 2 low print continues, leaving the bulls in control of the pair.

GBP Fundamental Forecast: A Critical Week of Brexit Votes.

GBPUSD Daily Price Chart (June 2018 – March 14, 2019)

Retail traders are 45.8% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a stronger bullish trading bias for GBPUSD.

Sterling Weekly Technical Outlook: Charts Keeping Positive Bias

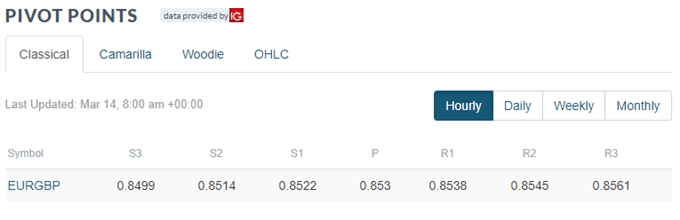

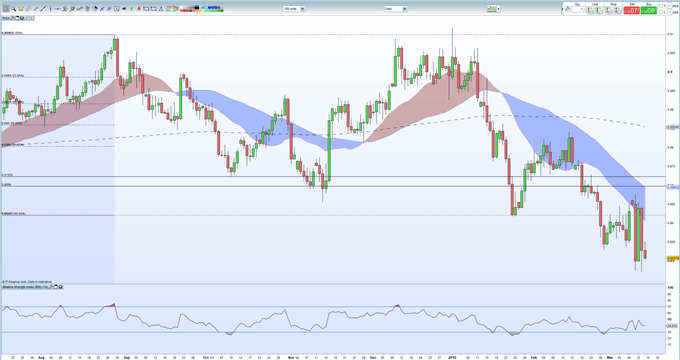

EURGBP – Technical Analysis

EURGBP touched the lowest level since May 2017 late Wednesday, printing at 0.8472, and looks likely to re-test this level in the short-term on a combination of a weak Euro and a currently strong British Pound. The break lower opens the way to an old swing-low at 0.8381, before the 161.8% Fibonacci extension at 0.8325 and the April 2017 swing-low at 0.8312. To the upside, strong resistance remains between 0.8604 and 0.8616.

EURGBP Daily Price Chart (July 2018 – March 14, 2018)

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on Sterling (GBP) – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.