GBPUSD Price, Volatility and Brexit Vote:

- PM May says she has secured legally binding changes.

- Attorney General Geoffrey Cox’s view will be crucial.

- Sterling soars ahead of the vote.

Q1 2019 GBP Forecast and USD Top Trading Opportunities

PM May returned from a meeting in Strasbourg with Jean-Claude Juncker saying that she has achieved ‘legally binding assurances’ over the Irish backstop, an issue that has divided her party and the country. PM May said these assurances would prevent the backstop in Ireland from becoming permanent, a crucial stumbling block in Brexit negotiations. All eyes will now turn to Attorney General Geoffrey Cox for his interpretation of these assurances and whether he believes that they are rigid and binding enough for him to recommend them, and the vote tonight at 7pm.

It is likely that during the morning that we will hear from the Attorney General and other MPs about their voting intentions. While Sterling may be radiating bullishness at the current time, all this can change in a second on the back of negative statement form the Attorney General, so traders need to remain alert.

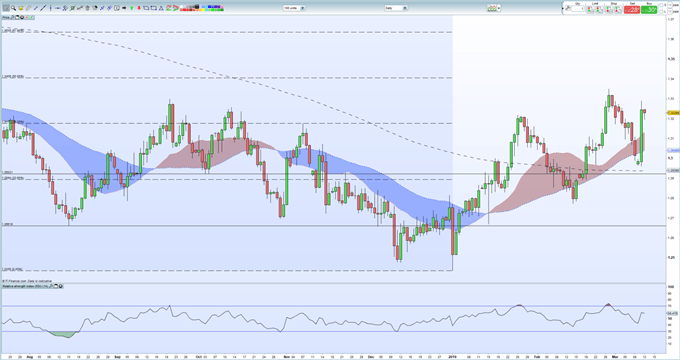

Sterling traders and investors have taken this development as a positive twist in the Brexit talks and pushed the British Pound back up to multi-week highs. Against the US dollar, Sterling hit 1.3289 late Monday, after having touched a 1.2959 low earlier in the session, while EURGBP fell from a high of 0.86770 to a low of 0.8475, the lowest level since May 2017. IN GBPUSD, the open above the 36.2% Fibonacci resistance level at 1.3177 adds a bullish push and open the way to the 2019 high at 1.3352 and the 50% Fibonacci level at 1.3406.

GBP Fundamental Forecast: A Critical Week of Brexit Votes.

GBPUSD Daily Price Chart (July 2018 – March 12, 2019)

Retail traders are 60.4% net-long GBPUSD according to the latest IG Client Sentiment Data, a bearish contrarian indicator. Recent changes in daily and weekly sentiment however currently suggest a mixed trading bias for GBPUSD.

Traders may be interested in two of our trading guides – Traits of Successful Traders and Top Trading Lessons – while technical analysts are likely to be interested in our latest Elliott Wave Guide.

What is your view on GBPUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author at nicholas.cawley@ig.com or via Twitter @nickcawley1.