UK Markets – Central Banks, NFPs and Brexit:

- Interest rate decisions from the European Central Bank, the Reserve Bank of Australia and the Bank of Canada.

- Add into the mix, US NFPs and ongoing Brexit negotiations.

You can access all of our Q1 2019 Trading Forecasts for a wide range of Currencies and Commodities, including GBPUSD along with our latest fundamental and medium-term term technical outlook.

Sterling (GBP) – A Potentially Testing Week Ahead

A raft of high-profile central bank rate decisions and releases will keep Sterling traders on their toes in the coming week. While no rate changes are expected, there is a possibility that one or all the central banks – ECB, BoC and RBA – may well give the market a dovish surprise. In addition, the latest monthly US Labour Report is released on Friday and may well add credibility to the currently strong US dollar.

DailyFX Economic Data and Events Calendar.

Brexit discussions continue, and the next two weeks are crucial and will decide Sterling’s fortune in the coming months. Talk continues to suggest that a last-minute settlement will be reached, either by March 29 or at the end of a two-to-three month extension of the Withdrawal Agreement.

GBP Fundamental Forecast: Positive Brexit Sentiment Feeding Through.

Sterling Weekly Technical Outlook: GBP Slipping but Still Positive.

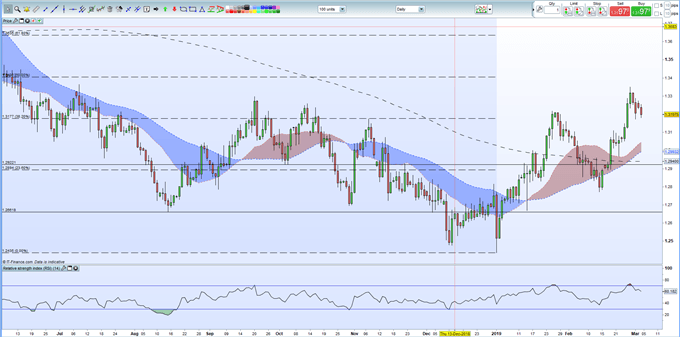

Sterling remains resilient against a range of currencies, although this bullishness may well be tested this week. EURGBP remains under 0.8620 as we write while GBPUSD trades either side of 1.3200.

GBPUSD Daily Price Chart (June 2018– March 4 , 2019)

IG Retail Sentiment data shows how clients are positioned in a wide range of currencies and financial assets.

--- Written by Nick Cawley, Analyst

To contact Nick, email him at nicholas.cawley@ig.com

Follow Nick on Twitter @nickcawley1