Crude Oil Talking Points:

- WTI Crude climbed comfortably above $57 as supply looks primed to fall

- The price increase follows production concerns as Saudi Aramco is slated to close a plant for maintenance and the Nigerian President announced supply cuts

- The developments help to reduce the non-OPEC supply concerns that have weighed on crude’s price

See how IG clients are positioned on the Dow, Crude oil and the US Dollar with our free IG Client Sentiment Data.

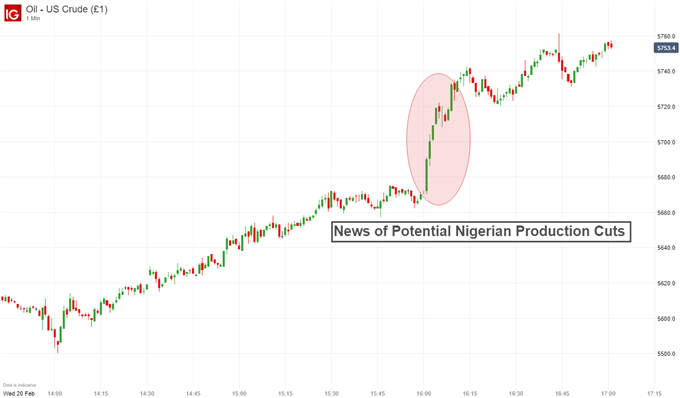

West Texas Intermediate (WTI) crude oil climbed over 1.8% on Wednesday as two supply headwinds unfolded in tandem. Most notably, Nigerian President Muhammadu Buhari is reportedly considering a reduction in crude output in pursuit of higher prices. If pursued, the decision would signal a conscious effort by an OPEC member to supplement recent crude production cuts by OPEC.

Elsewhere, Saudi Aramco announced they will temporarily close their Yanbu refinery for maintenance. According to Reuters, the refinery offers roughly 400,000 barrels per day in processing capacity.

The two events unfolded at a crucial time for crude oil bulls as non-OPEC supply concerns looked to pressure the fossil fuel’s price. On Tuesday, the EIA showed that US oil supply from several key shale regions is expected to increase by 84,000 barrels per day to 8.397 million barrels per day, notching a new record.

WTI Crude Oil Price Chart: 1-Minute Timeframe (February 20 2019) (Chart 1)

Together, the events drove crude oil north of $57. At the time of this article, crude oil traded 1.80% higher on the day around $57.43.As a reminder, given the US holiday on Monday, Wednesday night will see the API crude report with the Department of Energy crude inventories data scheduled Thursday at 16:00 GMT. View our economic calendar for real time updates on crude oil data and other economic events.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: Crude Oil Price May Falter as IEA Forecasts Supply Swamp

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.