Talking Points:

- The index of current conditions jumped 2.9 points to 115.2 from 112.3 in November

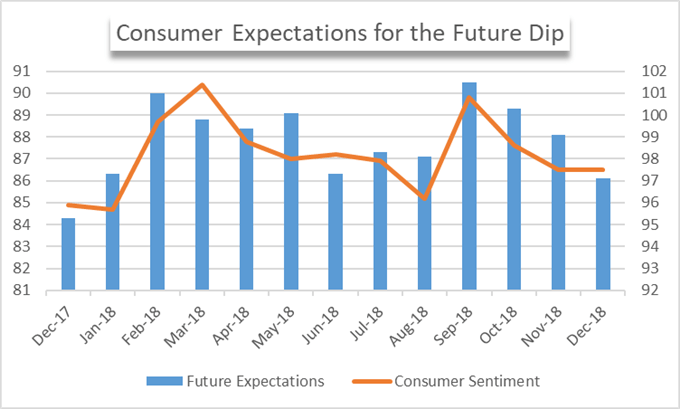

- Consumer expectations dipped which could suggest lower confidence in current conditions in coming reports

- Respondents noted hearing more negative news about job prospects as non-farm payrolls disappoint

Current Conditions Remain Strong

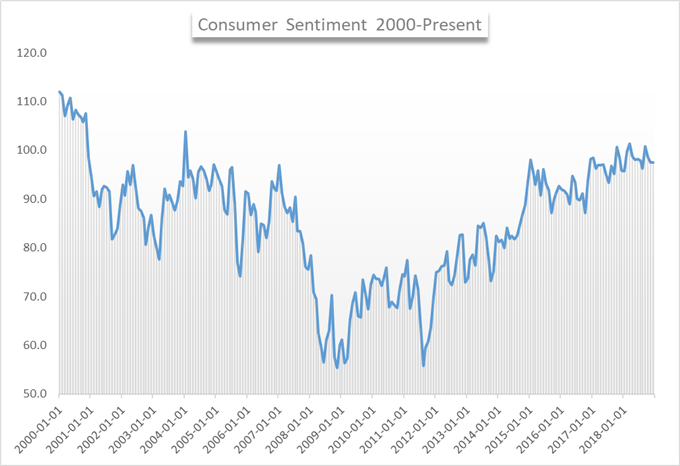

The monthly survey of consumers from the University of Michigan was released Friday morning to reveal no-change from November for consumer sentiment. The index read 97.5 and equals the average from January 2017 to December 2018. According to Richard Curtin, the survey’s curator, the last time the sentiment index was consistently above 90 for at least this long was from 1997 to 2000. During that time, the four-year average was 105.3.

Learn to trade around news events and data releases with our Introduction to Forex News Trading guide.

Respondents also saw strength in current economic conditions. Despite an equity market tumble and rising costs from the US-China trade war, the current conditions index rose to 115.2 from 112.3 in November. Conversely, future expectations read slightly lower.

The index of consumer expectations was the sole area of December’s report that read lower. While it suffered a slight decline, the change from 88.1 to 86.1 is well within the acceptable range and was easily offset by the uptick in current conditions.

That said, the index has declined for four months straight and various factors have been to blame. In previous declines, rising interest rates were cited as consumers voiced concern over higher borrowing costs. This month, the headline concerns were job prospects for the future.

Non-Farm Payrolls Fall Short

The concern was verified from a hard data perspective after a disappointing non-farm payroll release also on Friday. Still, the unemployment rate remained at a multi-year record 3.7%. With the list of concerns for the future growing, future reports may begin to see a slight dip in consumer sentiment. As a leading indicator, a dip in confidence would bolster the argument of many speculators that assert global growth is slowing. But currently, consumers remain confident and the holiday season offers an opportunity for increased consumer expenditure.

--Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more: S&P 500 Plunges, DAX Enters Bear Market on Trade War Fears

DailyFX forecasts on a variety of currencies such as the US Dollar or the Euro are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.