ASEAN Weekly Outlook – G20 Summit, Trade Wars, US Dollar, Fed, Philippine Peso, Indonesian Rupiah

- ASEAN FX had comeback amidst Fed Chair Jerome Powell speech as US Dollar struggled

- Implications of the G20 Leaders’ Summit may revive 2019 Fed rate hike bets, boosting USD

- For now, risk appetite might improve, boosting PHP & IDR. High crude oil prices a risk

BACKGROUND: A Brief History of Trade Wars, 1900-Present

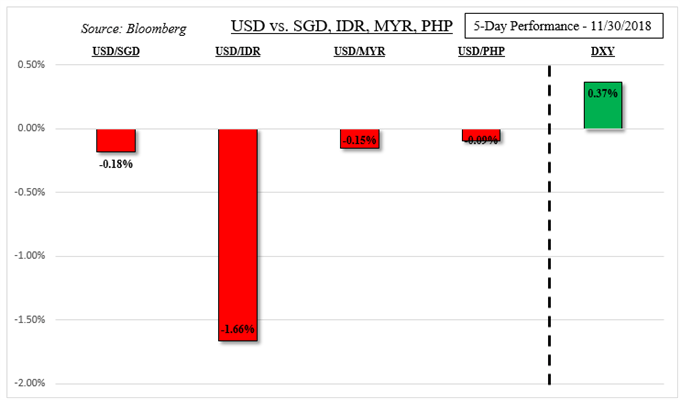

The US Dollar struggled to hold its ground against some of its major counterparts last week and this allowed for ASEAN currencies to gain ground against it. Fed Chair Jerome Powell and his comment on rates being just under the neutral range dented 2019 rate hike bets as USD had its worst day in just about two weeks. This development largely overshadowed China’s Manufacturing sector lacking growth in November.

One particular outperformer in the region was the Indonesian Rupiah which appreciated to its highest against the US Dollar since June. Accompanying USD/IDR’s performance in recent months was the Jakarta Composite Index climbing to its highest since April. This comes amidst decreasing fears of a US China trade war, lower crude oil prices and increased investment into domestic stocks from foreigners.

The week ahead contains a couple of notable economic event risks for the Asian region, but the implications of last weekend’s G20 Leaders’ Summit carry important fundamental themes for the year ahead. For starters, the United States and China agreed on a trade ceasefire for 90 days. Come 2019, President Donald Trump said that Chinese impart tariffs will not increase to a 25% rate from the current 10%.

However, China must figure out the amount of agricultural and industrial goods to purchase from the world’s largest economy. This is to help reduce its trade surplus with the US. While a reduction in US China trade war fears can bode well for sentiment in the immediate sense, the longer-term implications are not as straightforward.

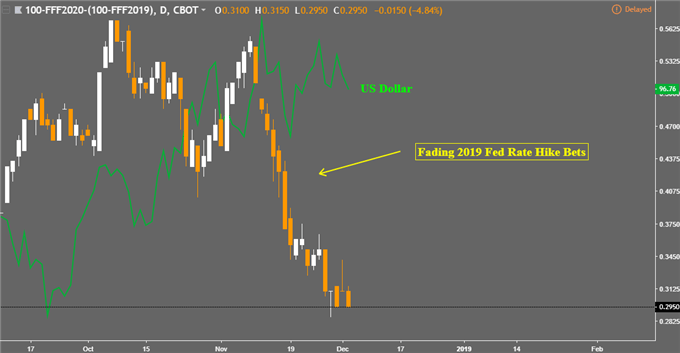

This is because the global growth outlook for 2019 could be improved should trade wars slowly die down. What this means for the Fed is more reasons to be optimistic about economic growth in the year ahead. Lately, the US Dollar has been struggling to appreciate as 2019 Fed rate hike bets declined amidst a cautious tone from the central bank towards their world outlook.

Looking at the chart below, you can see how this dynamic unfolded. It is the difference between the implied rate (as indicated by Fed funds futures) at the beginning of 2020 and subtracting from that the beginning of 2019. As the yield falls (as it has been doing since November), that shows decreasing hawkish expectations.

US Dollar versus Hawkish Fed Bets

Chart created in TradingView

As such, we could be in for a revival in near-term Fed rate hike bets which would bolster the US Dollar while placing emerging market currencies such as the Indonesian Rupiah or Philippine Peso at risk. Furthermore, it seems as though Russia and Saudi Arabia agreed on crude oil production cuts during the Summit. A resumption in rising oil prices could bode ill for the Philippines and the PHP.

Turning our attention back to immediate event risk, the Philippine Peso eyes November’s local CPI report. The headline inflation rate is expected to tick down to 6.3% y/y from 6.7%. Disinflation is the Philippine central bank’s (BSP) projection for the year ahead and the recent decline in oil prices may help. But, the BSP has made it clear that it wants to see sustained lower CPI for it to pause hiking rates. If the commodity enters a rally based on estimates of OPEC production cuts, slower inflation may only be temporary.

If that results in another emerging market selloff, especially if the US Dollar rallies, we may see regional central banks taking more action to stem selloffs in their currencies. For now, we will get foreign exchange reserves from nations such as Malaysia and Singapore. Given the pause in Malaysian Ringgit weakness for example, we will see how their respective central banks approached upholding their currencies.

Read our ASEAN Technical Outlook to see what moves USD/MYR, USD/PHP, USD/IDR and USD/SGD could also make next!

FX Trading Resources

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter