Bitcoin, Bitcoin Cash, Ethereum, Ripple: Prices, Charts and Analysis

- Technical support levels broken with ease.

- Bitcoin market capitalization under $100 billion – lowest level in 13-months.

Cryptocurrency Market Slumps to a Multi-Month Low

A second selling wave hit the cryptocurrency market over the weekend, driving the whole market capitalization below $200 billion and Bitcoin’s (BTC) below $100 billion - the first time since late - October 2017. Last week’s contentious Bitcoin Cash (BCH) fork pushed prices lower, breaking various important support levels across the space, while a report released on Friday by the SEC on two ICOs fueled further selling. The two ICO issuers, CarrierEQ.Inc (Airfox) and Paragon Coin agreed to return funds to harmed investors, register their tokens as securities, file periodic reports with the SEC and pay penalties. On the back of this ruling, Ethereum has been hit slightly harder than other tokens as most of the ICOs issued in 2017 were raised via Ethereum and s sell-off of these ICOs could have a knock-on effect on Ethereum.

Bitcoin, Ethereum, Ripple Prices Continue to Collapse

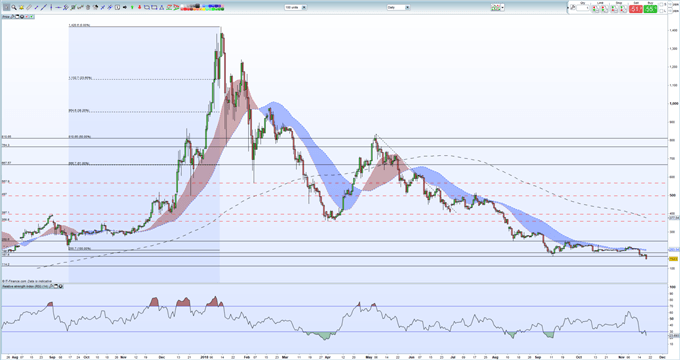

The latest Bitcoin (BTC) chart looks weak but currently oversold and may push slightly higher ahed of any further sell-offs. Horizontal support from the October 2017 swing-low at $5,121 is being tested with the next level of noted support pegged at $2,970, the September 15, 2017 swing low. The RSI indicator is in oversold territory and may provide some relief from the current bout of selling.

Bitcoin (BTC) Daily Price Chart (May – November 19, 2018)

The Ethereum (ETH) chart looks negative with the latest sell-off now targetting the May 2017 spike low at $114, compared to a current level of $153. The latest bear move has also seen ETH lose its place as the second-largest cryptocurrency to Ripple in the market capitalization table. Ethereum traded as high as $1,420 in January this year.

Ethereum (ETH) Daily Price Chart (August 2017 – November 19,2018)

We look at Bitcoin, Ethereum, Ripple, Bitcoin Cash and a variety of other cryptocurrencies, at our Weekly Cryptocurrency Webinar every Wednesday.

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the cryptocurrency market? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.