Asia Pacific Market Wrap – Nikkei 225, Shanghai Composite, ASX 200, Australian Dollar

- Nikkei 225 follows S&P 500 lower, Shanghai Composite rallies as most other little changed

- Australian Dollar rallied on jobs report, causing adverse knock-on effects on the US Dollar

- ASX 200 dominant downtrend still in play, October 26th low eyed if immediate support breaks

We released our 4Q forecasts for equities in the DailyFX Trading Guides page

On Thursday, Japanese benchmark stocks indexes traded lower while Chinese ones headed higher in an otherwise relatively quiet session. The Nikkei 225 gapped lower, following the lackluster performance from the S&P 500 on Wall Street amidst Apple shares entering into bear market territory. Not surprisingly, information technology weighed on Japanese equities. Granted, consolidation ensued after the gap.

The Shanghai Composite rose about 0.70% as it headed for its highest close in one week. Meanwhile in Australia and South Korea, the ASX 200 and KOSPI traded little changed. Stocks showed little volatility to commentary from Fed Chair Jerome Powell which acknowledged that global growth is seeing a slowdown this year. He also added that the US economy is in a good pace that that it can grow faster.

Volatility could be found in the Australian Dollar which soared on a better-than-expected local jobs report. Australian front-end government bond yields rallied, signaling increased RBA rate hike bets. While this may drive the Aussie a little bit higher in the near-term, gains may not last down the road. The central bank remains very well patient before raising rates and is considerably less hawkish than the Fed.

Gains in AUD did weigh against the US Dollar though, but more progress needs to be done in AUD/USD to confirm a reversal of the dominant downtrend. S&P 500 futures are little changed heading into the European and US sessions, perhaps insinuating calm trading to come. But stocks and risk-sensitive FX remain vulnerable to stray negative Brexit progress and Italian budget headlines

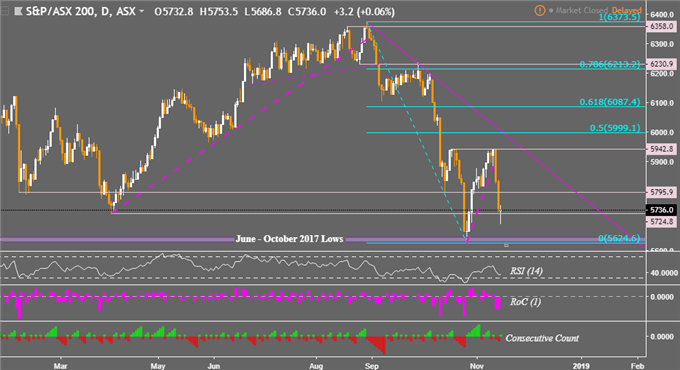

ASX 200 Technical Analysis

The ASX 200’s attempt to test the descending trend line from September was stopped by a horizontal resistance at 5,942. This area is a combination of the mid-October and November highs. Prices have since fallen through support at 5,795, stopping at 5,724 which is the April low. A descent through that will open the door to test the October 26th low at 5,624 which if taken out, may see the dominant downtrend resume.

ASX 200 Daily Chart

Chart created in TradingView

Fundamental Forecast:

Crude Oil Prices May Extend Fall as Fed Boosts USD, Sinks S&P 500

FX Trading Resources

- See how equities are viewed by the trading community at the DailyFX Sentiment Page

- Just getting started? See our beginners’ guide for FX traders

- Having trouble with your strategy? Here’s the #1 mistake that traders make

- Join a free Q&A webinar and have your trading questions answered

--- Written by Daniel Dubrovsky, Junior Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter