Bitcoin, Bitcoin Cash, Ethereum, Ripple: Prices, Charts and Analysis

- Cryptocurrency market slumps – double digit losses over the last 24-hours.

- Important support levels broken leaving cryptos vulnerable.

Cryptocurrency Market a Sea of Red

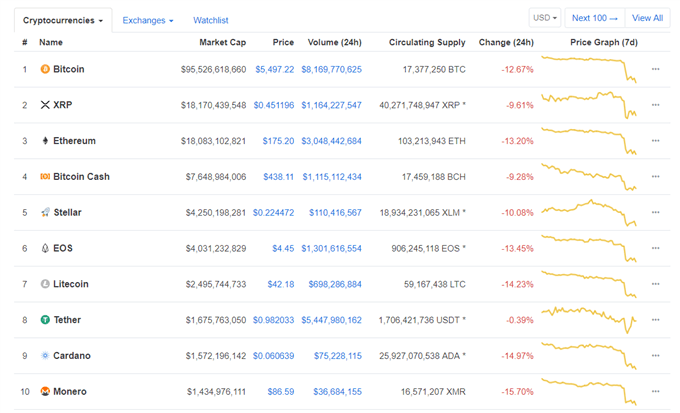

Cryptocurrencies across the board slumped yesterday and in early trade today with little in the way to explain the sharp move. The market as a whole lost over $25 billion and is now back at lows (USD180 billion) last seen in late October 2017. The cryptocurrency market cap peaked at USD831 billionin early January this year.

Data via CoinMarketCap.

While there was no identifiable catalyst for the move, we have spoken in length over the last few weeks about the possibility of a breakout due to the prevailing low volume/tight trading range environment. A sentiment driven market, such as the crypto currency space, coupled with client positioning heavily skewed to the longside, is a set-up that is extremely vulnerable to sell-offs.

The speed with which cryptos crashed Wednesday indicate that there is very little, fresh money, buying interest in the market and that stops were limited in size. In addition the cost of mining Bitcoin is becoming prohibative for some miners, placiung additional pressure on the space.

Bitcoin Cash Hard Fork Causing Market Ripples | Webinar

Bitcoin, Ethereum, Ripple Prices Stuck in a Rut | Webinar

Bitcoin, Ethereum, Ripple: Low Volatility, High Risk | Webinar

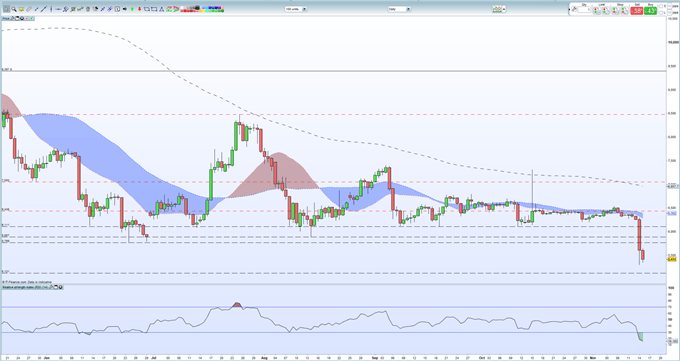

Looking at the charts, old support levels are now likely to become new resistance levels and the path of least resistance for most coins is lower. The next level of horizontal support for Bitcoin nows kicks in at USD5,121 with resistance pegged at USD5,769.

Bitcoin (BTC) Daily Price Chart (May – November 15, 2018)

We look at Bitcoin, Ethereum, Ripple, Bitcoin Cash and a variety of other cryptocurrencies, at our Weekly Cryptocurrency Webinar every Wednesday.

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the cryptocurrency market? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.