Talking Points

- UK Prime Minister May announced that her cabinet agreed to a Brexit deal with the EU; the Brexit saga is far from over, however.

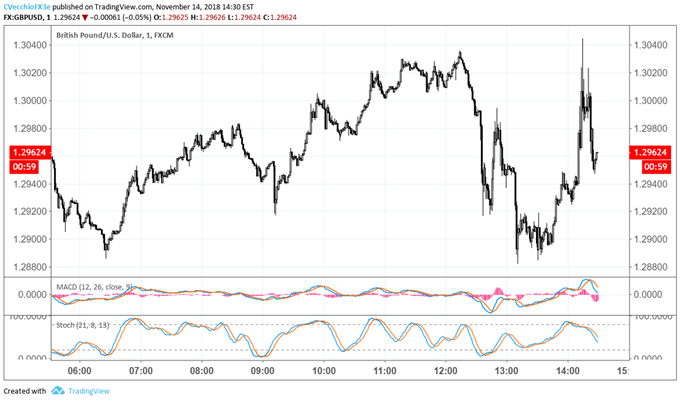

- The British Pound has had an incredibly volatile, but is still searching for direction.

- Retail traders remain net-long the British Pound, so the outlook remains bearish.

See the DailyFX Economic Calendar and see what live coverage for key event risk impacting FX markets is scheduled for next week on the DailyFX Webinar Calendar.

The British Pound has endured a volatile trading session in what may be a sign of things to come. A day marked by rumors over deal-or-no-deal, cabinet resignations, and a no confidence vote has yielded to an announcement by UK Prime Minister Theresa May that her cabinet has agreed to a Brexit deal with the European Union.

A few key details are known at this time. Mainly, the EU and the UK have agreed to plan for a free-trade area with joint cooperation on customs policies. The EU and the UK will remain a "single customs area" until a border solution for Ireland is in place. To this end, while no solution for Ireland has been finalized, both parties have agreed to ensure no hard border.

The coming days will likely prove as rocky for the British Pound as today did. At UK PM May’s press conference earlier, she suggested that there will be “difficult days” ahead, even if she feels the Brexit deal agreed upon is the best that could be achieved, and its “in the UK’s interest.”

Just because the UK prime minister and her cabinet have reached an agreement doesn’t mean the Brexit saga is over; far from it. In fact, the most intense period for markets is on the horizon. Here’s what comes next:

- The May-led government will now try to whip the votes in parliament to accept the deal over the coming weeks;

- A new EU-UK summit will be scheduled in the near future, rumored to be November 25;

- Parliament will scrutinize the deal; it’s rumored that neither Brexiteers nor Remainers will be happy will the agreement; and

- Due to a lack of majority in parliament, the May-led government needs support from both Tory and Labour; amendments and alterations are possible at this stage, sometime in early/mid-December,

There are still other variables to consider. Along the way, it’s possible that cabinet ministers resign; if so, a no confidence vote could be called. A challenge to leadership at this stage of the Brexit negotiations would be an implicit rejection of the deal negotiated by UK PM May; in turn, a second Brexit referendum, and even a second Scottish independence referendum wouldn’t be out of the question in the first half of 2019.

GBP/USD Price Chart: 1-minute Timeframe (November 14, 2018) (Chart 1)

Read more: US Dollar Losses Hit Pause after October CPI; Focus Remains on Brexit

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

View our long-term forecasts with the DailyFX Trading Guides