Bitcoin, Ethereum and Ripple: Prices, News and Technical Analysis

- Ethereum back to $180 after hitting a 14-month nadir at $167.

- Cryptocurrency market remains heavy and below $200 billion.

Buying the Cryptocurrency Bounce: Caveat Emptor

If we apply the liteal meaning of the Latin phrase Caveat Emptor then, when buying cryptocurrencies the buyer should be aware of all risks and flaws of the product and assess whether it is suitable for them. The current market where prices fall, partially rebound and then fall again can prove appealing to buyers who believe the market is going to return to its all-time highs. However the course of action over this year would have been to sell rallies, not buy dips, or stay away from the space entirely.

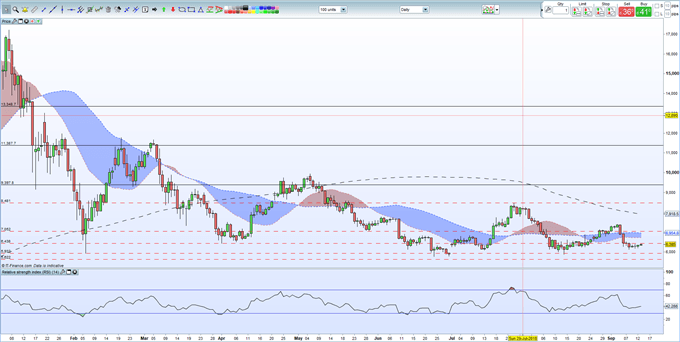

Bitcoin (BTC) Continues to Dominate the Space

The latest market mini-bounce should be treated with caution as recent price action has seen sellers dominate the market with little support seen. Bitcoin (BTC) remains the ‘best of a bad bunch’ in the recent bear market and maybe starting to find a base, although it still has potential to trade down to around $5,600. On the upside there is resistance between $6,400 and $7,000 which would need to be cleared decisively before $7,400 comes into play.

Bitcoin (BTC) Daily Price Chart (January – September 13, 2018)

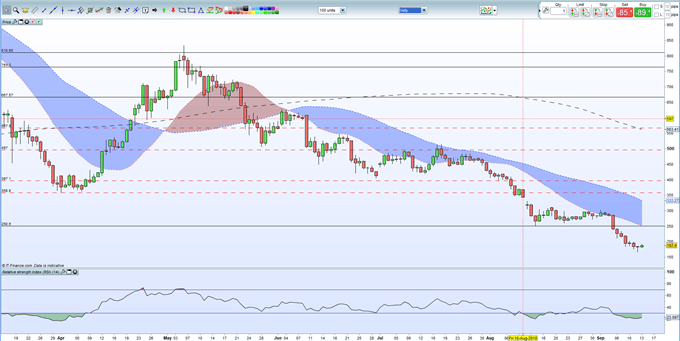

Ethereum (ETH) Sell-Off Stalls for Now

The recent weakness in the ICO market fed through into Ethereum (ETH) and caused the market to fall to levels last seen over a year ago. The recent pull-back, from $167 to $180, should be taken in context of the ongoing downtrend in the market, especially clear from around May onwards. Previous support levels, based on old swing-lows, have been broken with ease, and rebounds have become shallow as sellers continue to dominate the space. Ethereum is currently getting some support from an oversold RSI indicator but ETH is under all three moving averages and will need to move back above $358 to break out of its negative trend.

Ethereum (ETH) Daily Price Chart (March – September 13, 2018)

Cryptocurrency Trader Resources – Free Practice Trading Accounts, Guides, Sentiment Indicators and Webinars

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the latest market crash? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.