Cryptocurrency Prices, News and Technical Analysis

- Ethereum slumps further as ICO sellers continue.

- US federal judge says US securities laws cover ICOs

Cryptocurrency Market in Turmoil

Heavy selling continues unabated in the cryptocurrency market with Etheum and Bitcoin Cash among the worst hit and both down around 10% in the last 24 hours. Ethereum has slumped in the last week, falling from a high of $282 last Wednesday to a current level of $171. The token continues to hit negatively from the sell-off in the ICO market – mostly based on the ether blockchain – which has seen constant ETH selling. In addition, a ruling yesterday in the US that ICOs are covered by US security laws added to the negative sentiment. While ICOs will be judged on a case-by-case basis, the decision allows the SEC the powers to bring criminal proceedings against fradulent companies.

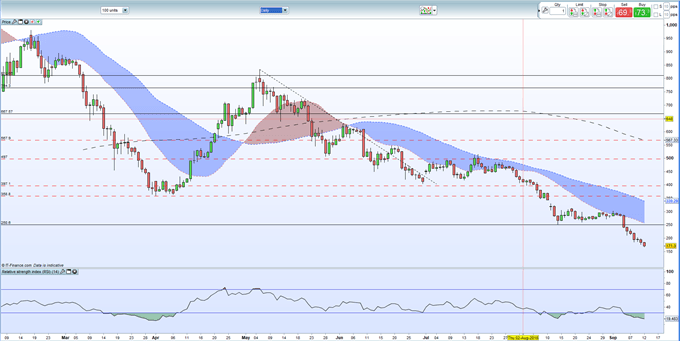

It has become increasingly difficult to find true levels of technical support in a market that has rallied and slumped in such a quick time. Old support levels have been broken with ease and in most cases, cryptos have given back all, or nearly all, of their late 2017 - early 2018 rally. We identified some levels of support last week - at a deep discount to where the tokens were then trading – and we have already downgraded Ethereum further.

Indicative Cryptocurrency Support Levels From September 6

Bitcoin (BTC) -- $5,622 (Mid - November, 2017) --Currently $6,249

Bitcoin Cash (BCH) -- $340 area (Mid - October 9, 2017) -- Currently $420

Ethereum (ETH) -- $200 (Mid – September, 2017) – Now $112 - $140 area –- Currently $171

Ripple (XRP) -- $0.20 area (Mid - December, 2017) – Currently $0.255

Litecoin (LTC) -- $40 area (Late - August, 2017) – Currently $49

Bitcoin (BTC), Ether (ETH), Ripple (XRP) Prices Continue to Plunge – September 6

Bitcoin (BTC) and Ethereum (ETH) Price Analysis Remains Negative - September 10

Ethereum (ETH) Daily Price Chart – Remains Heavily Negative - (September 12)

Retail Sentiment Remains Heavily Skewed

Bitcoin’s market dominance continues to nudge back higher and is currently around 57.6% as the altcoin market takes a bigger hit. Bitcoin remains the pre-eminent cryptocurrency and this maturity is helping to cushion BTC against the worst of the market falls. Looking at the IG Client Sentiment Indicator shows us the positioning of retail in various cryptocurrencies and how this can be used as an overall gauge of the market. Daily and weekly positional changes give us clues to sentiment shifts but the overall take out is that retail remain heavily long in a market that continues to make new lows for the year.

Bitcoin – Traders are 76.9% net-long.

Ethereum – Traders are 91.4% net-long.

Ripple – Traders are 95.5% net-long.

Litecoin – Traders are 91.7% net-long.

Bitcoin Cash – Traders are 86.8% net-long.

We look at Bitcoin, and other cryptocurrencies, at our Weekly Cryptocurrency Webinar every Wednesday.

Cryptocurrency Trader Resources

If you are interested in trading Bitcoin, Bitcoin Cash, Ethereum, Litecoin or Ripple we can help you begin your journey with our Introduction to Bitcoin Trading Guide.

What’s your opinion on the latest market crash? Share your thoughts and ideas with us using the comments section at the end of the article or you can contact me on Twitter @nickcawley1 or via email at nicholas.cawley@ig.com.

--- Written by Nick Cawley, Analyst.