Check out the brand new DailyFX trading forecasts for Q3

MARKET DEVELOPMENT – BREXIT DEAL IN A MONTH IS REALISTIC SAYS BARNIER

GBP: Yet again the Pound has received a boost by EU’s Barnier with the Chief Brexit Negotiator stating that a Brexit deal within 6-8 weeks is realistic. As such, the Pound cleared 1.30 against the greenback breaking above the August 30th high at 1.3043, while EURGBP saw a dip below 0.89. As mentioned previously, risk-reward continues to favour GBP upside.

SEK: The Swedish Krona is notably firmer amid an unwind of the political risk premium after gains for the nationalist and anti-immigration party Sweden Democrats party were smaller than what had been predicted by several polls. While the Swedish election has led to a political gridlock with weeks if not months to form a government, market fears have ultimately eased with the Sweden Democrats receiving less support than expected.

CHF: The Swiss Franc is underperforming this morning with EURCHF climbing back above 1.12. Renewed optimism regarding Italy’s new government would be prudent with its fiscal policies prompted a narrowing of the Bund-BTP spread, which now stands at 235bps. Consequently, the risk premium attached to Italy has eased, which in turn has sparked outflows from the typically safe haven Swiss Franc.

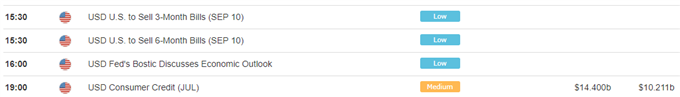

DailyFX Economic Calendar: Monday, September 10, 2018 – North American Releases

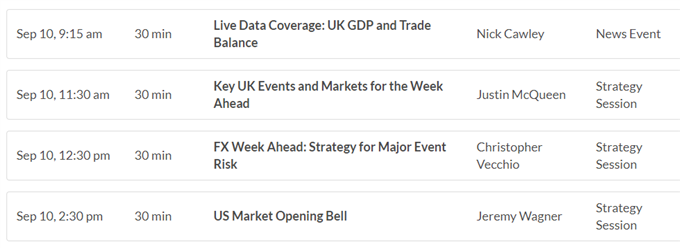

DailyFX Webinar Calendar: Monday, September 10, 2018

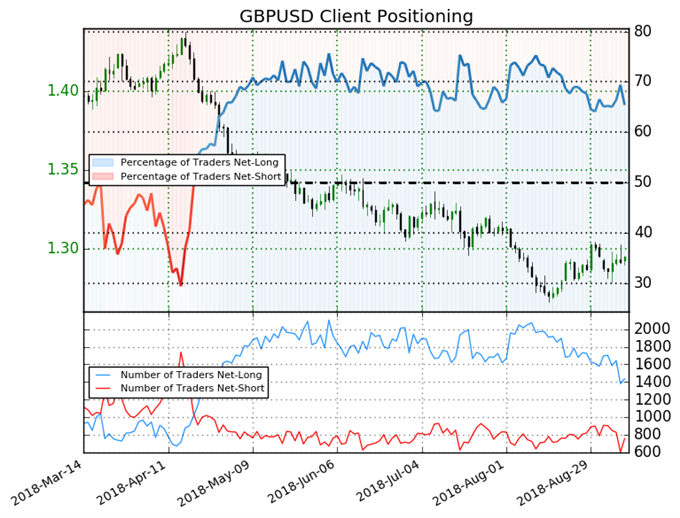

IG Client Sentiment Index: GBPUSD Chart of the Day

GBPUSD: Data shows 65.4% of traders are net-long with the ratio of traders long to short at 1.89 to 1. In fact, traders have remained net-long since Apr 20 when GBPUSD traded near 1.40768; price has moved 8.0% lower since then. The number of traders net-long is 8.8% lower than yesterday and 12.8% lower from last week, while the number of traders net-short is 5.2% lower than yesterday and 13.7% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBPUSD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBPUSD trading bias.

Four Things Traders are Reading

- “Bitcoin (BTC) and Ethereum (ETH) Price Analysis Remains Negative” by Nick Cawley, Market Analyst

- “Weekly CoT Sentiment Update for Major FX, Commodities, and Indices" by Paul Robinson, Market Analyst

- “GBPUSD & EURGBP - Supported by Strong UK Economic Growth” by Nick Cawley, Market Analyst

- “EURUSD Bearish Bias Towards Crucial Support After Strong US Wages” by Justin McQueen, Market Analyst

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX